Stream - Tax pooling - a better way for 7 May

Tax pooling - a better way to manage 7 May

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions. Clyden has also previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Login - Tax pooling - a better way for 7 May

Tax pooling - a better way to manage 7 May

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions. Clyden has also previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Budget 2023 - review with Tony Alexander

Budget 2023 - review

with Tony Alexander

Friday 19 May

10am – 11am

Join our NZ Budget 2023 Review with Tony Alexander, the morning following the Government’s big announcements. As one of New Zealand’s leading economists, Tony will be sharing key takeaways from Budget 2023 and his expert view on New Zealand’s economic outlook.

Budget 2023 - review with Tony Alexander

Friday 19 May

10am – 11am

Join our NZ Budget 2023 Review with Tony Alexander, the morning following the Government’s big announcements. As one of New Zealand’s leading economists, Tony will be sharing key takeaways from Budget 2023 and his expert view on New Zealand’s economic outlook.

What we'll cover

- What does Budget 2023 mean for New Zealand’s economy and businesses?

- How is Budget 2023 going to help the cost of living challenges?

- The big Budget 2023 tax implications, co-presented with Chris Cunniffe, TMNZ CEO

- As well as Q&A

Who this is for

This online seminar is for our tax agents and accountants to gain insights on how the Government’s 2023 Budget will impact their business and their clients. Your colleagues and connections are also welcome to join.

Our speakers

Tony Alexander, Independent Economist

Tony is a renowned economics analyst and commentator in New Zealand. He worked for BNZ for 26 years, 25 of which were as Chief Economist. His focus has always been on translating developments and trends in the economics sphere into a language which people can understand, aiming to help kiwis make better decisions for their businesses, investments, home purchases, and people.

Chris Cunniffe, CEO, TMNZ

Chris has been leading TMNZ as CEO for over 10 years. He was made a CA ANZ Fellow in 2019 and has been on the CAANZ Tax Advisory Group for more than 20 years. Before TMNZ, Chris was Head of Tax at Air New Zealand and Bank of New Zealand.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

RDTI help

RDTI in-year payments help

RDTI tax credits are issued to participating businesses after they have filed their income tax return and their RDTI Supplementary Return has been processed. This can mean a business may not receive their credit until 12-18 months after the end of the income year during which their R&D was conducted.

The RDTI in-year payments scheme is designed to help businesses performing eligible R&D receive cash support closer to when they incur the corresponding R&D costs. This cash support is in the form of an interest-free Government loan.

The business must meet the following criteria to qualify for in-year payments:

- The customer has applied for RDTI by having CAM, GA, or submitting their GA through Inland Revenue and

- your business is a going concern and

- The client has no outstanding matured RDTI in-year payments from the previous income year (not applicable to the first year).

If you have not yet submitted your GA or CAM application, you can contact Callaghan Innovation’s team, who can provide free assistance until the business’ GA/CAM submission: https://www.rdti.govt.nz/we-provide-free-tailored-support/.

RDTI in-year payments are administered by Tax Management New Zealand (TMNZ). After applying for RDTI, you can create an account to begin in-year payments. Once you have logged in and entered all of the required information to onboard, then we will collect information about your RDTI submission, conduct Anti-Money Laundering (AML) and Due Diligence (DD) checks, and seek permission to access the business’ RDTI Account

A TMNZ RDTI specialist will work with the Ministry of Business, Innovation and Employment (MBIE) to review the application. MBIE holds all decision-making authority for the scheme. Once your application has been accepted, you can request payments for any open periods.

We will announce details on how people can request payments and how loan repayments work soon.

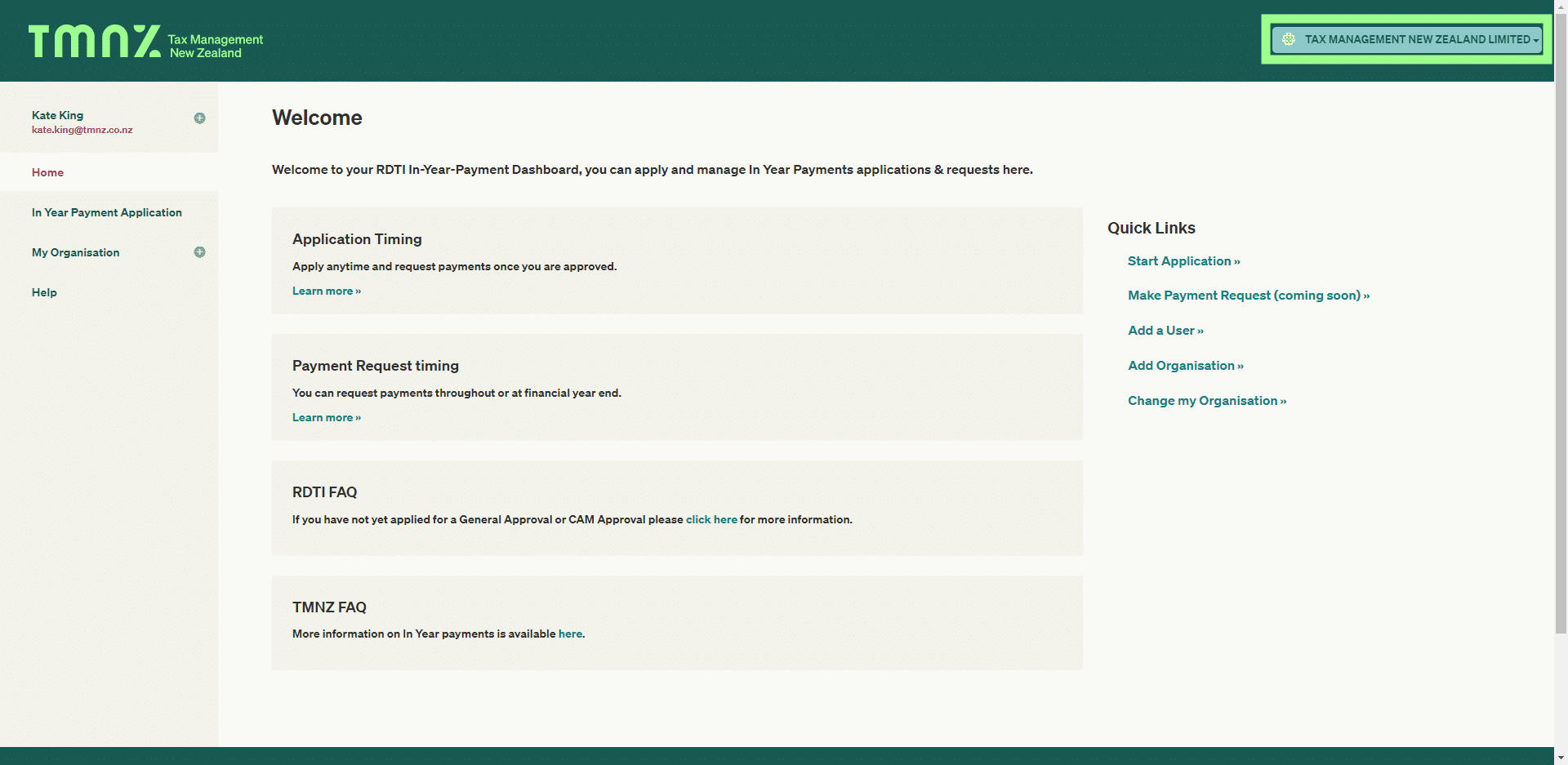

After completing the onboarding process, you will have access to your registered organisation’s dashboard.

Your Organisation

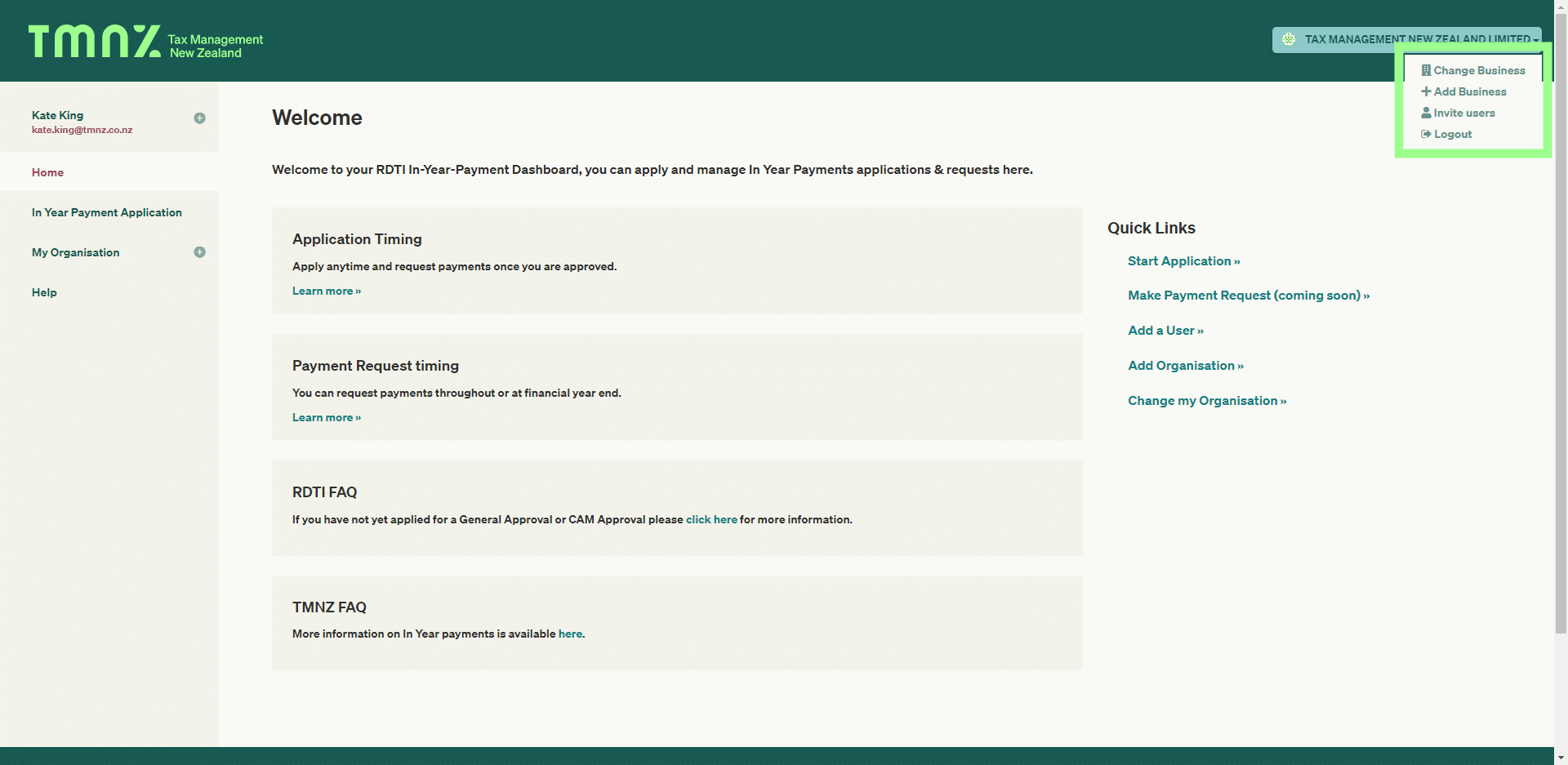

You can access all the options related to an organisation by clicking on the name at the top right of the page.

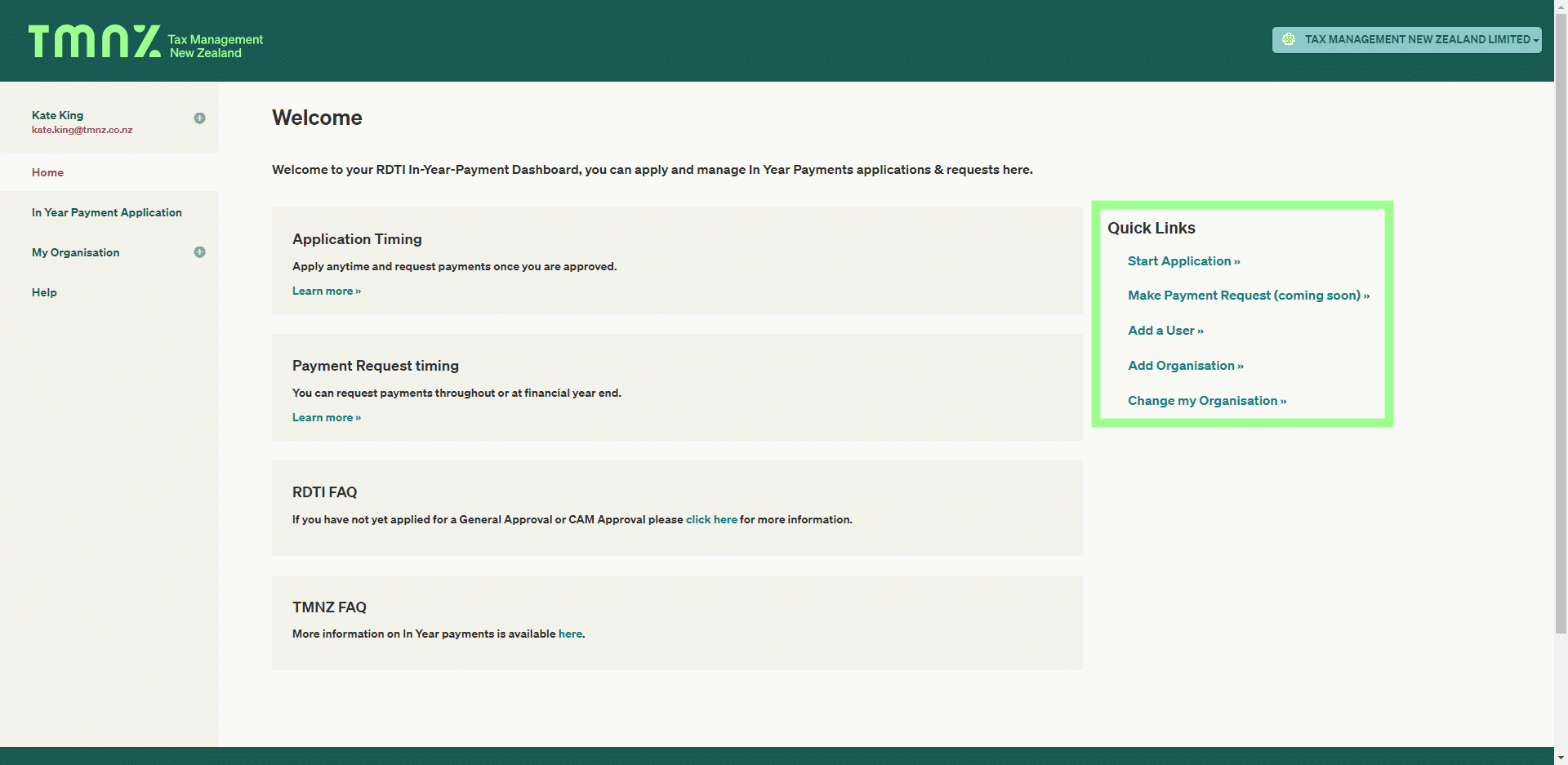

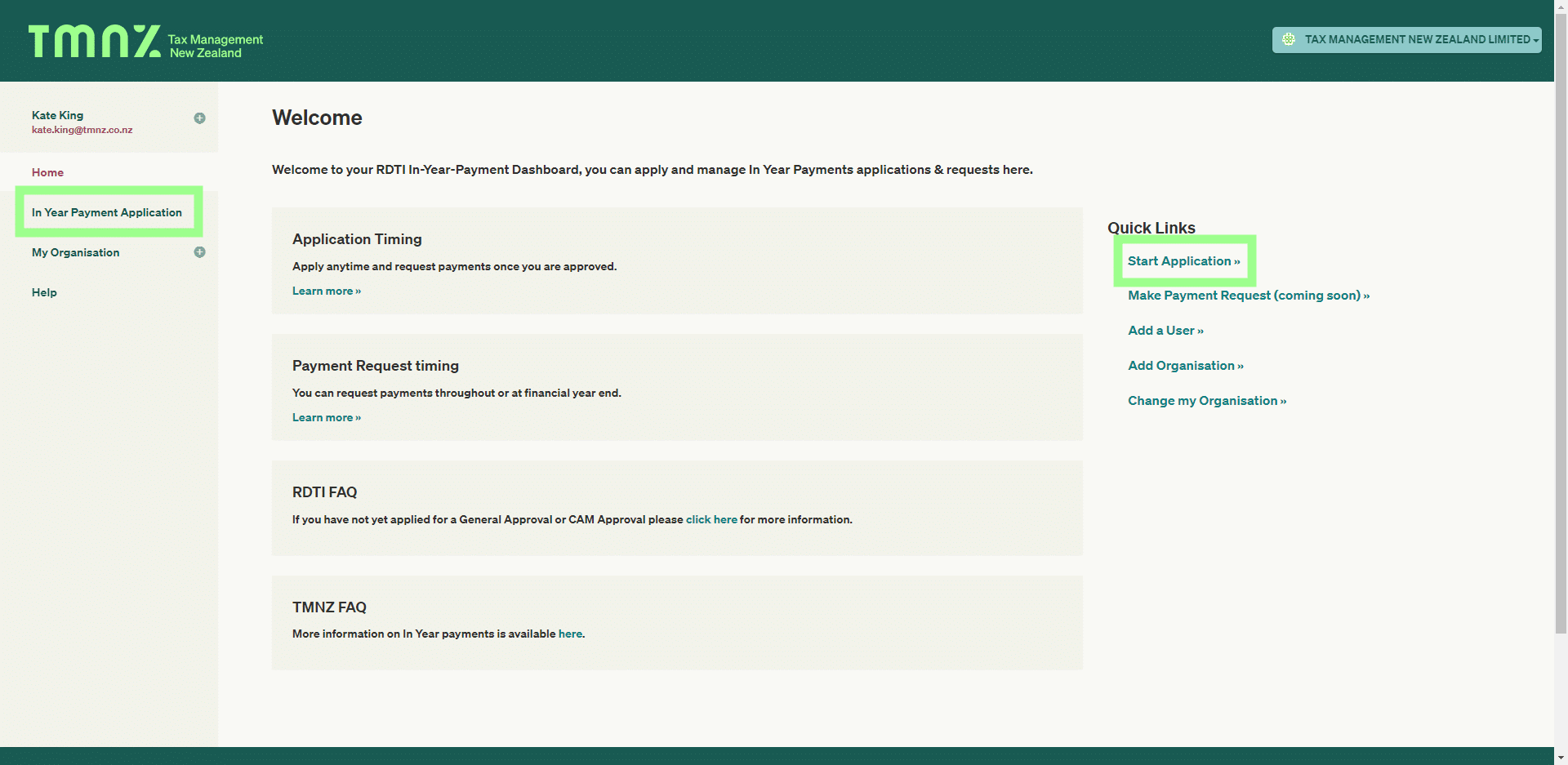

Quick Link Option

You can access this content on the right-hand side of your home screen. These options provide everything you can manage with your login. You can create a new business, invite other users to access the organisation’s RDTI in-year payment content, log in as another business or begin your application.

Let’s look at these options:

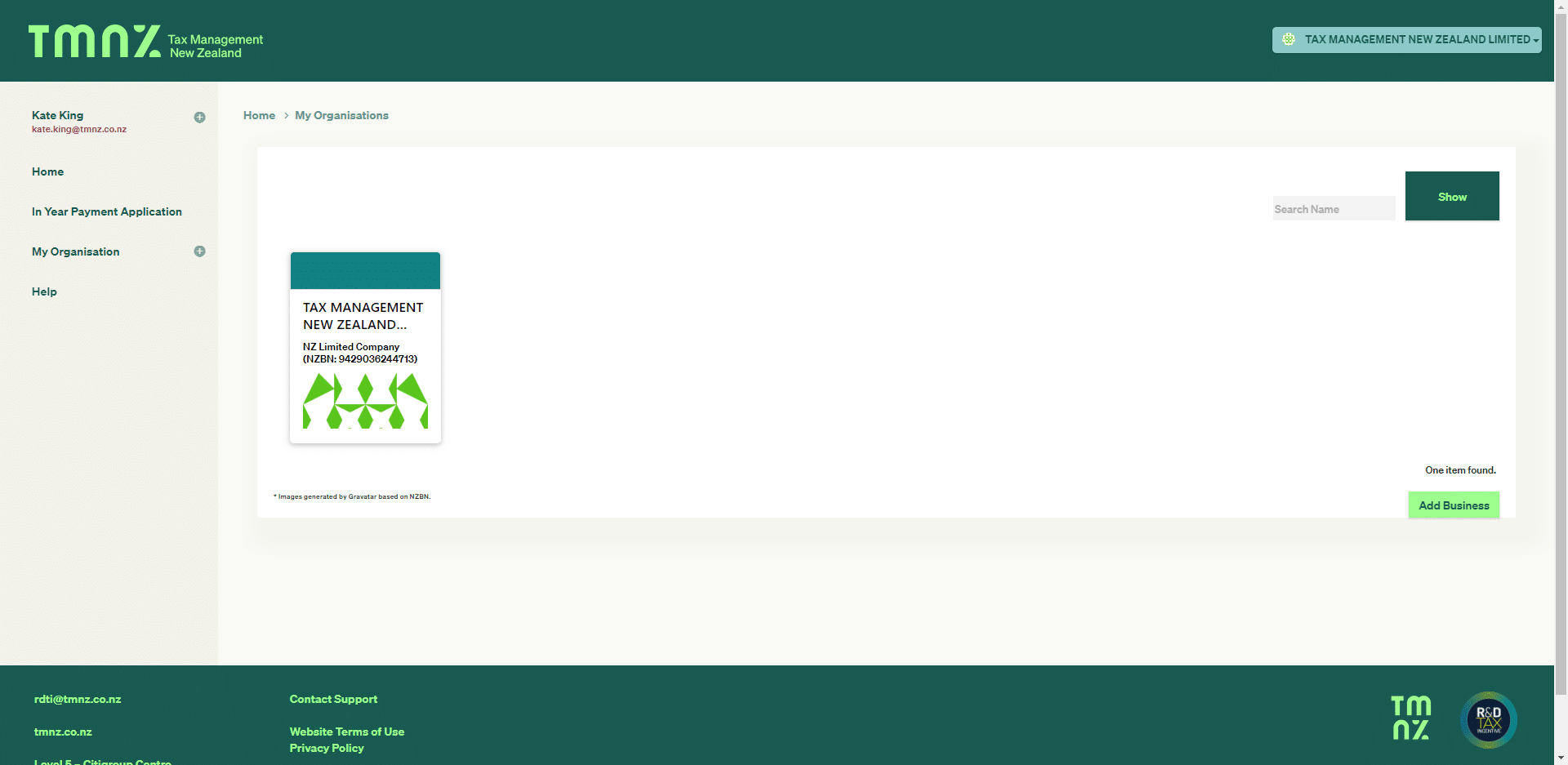

— Change my Organisation

Select this option to manage in-year payments with a different organisation. Once you are on the My Organisations page, click on the organisation you want to log in as.

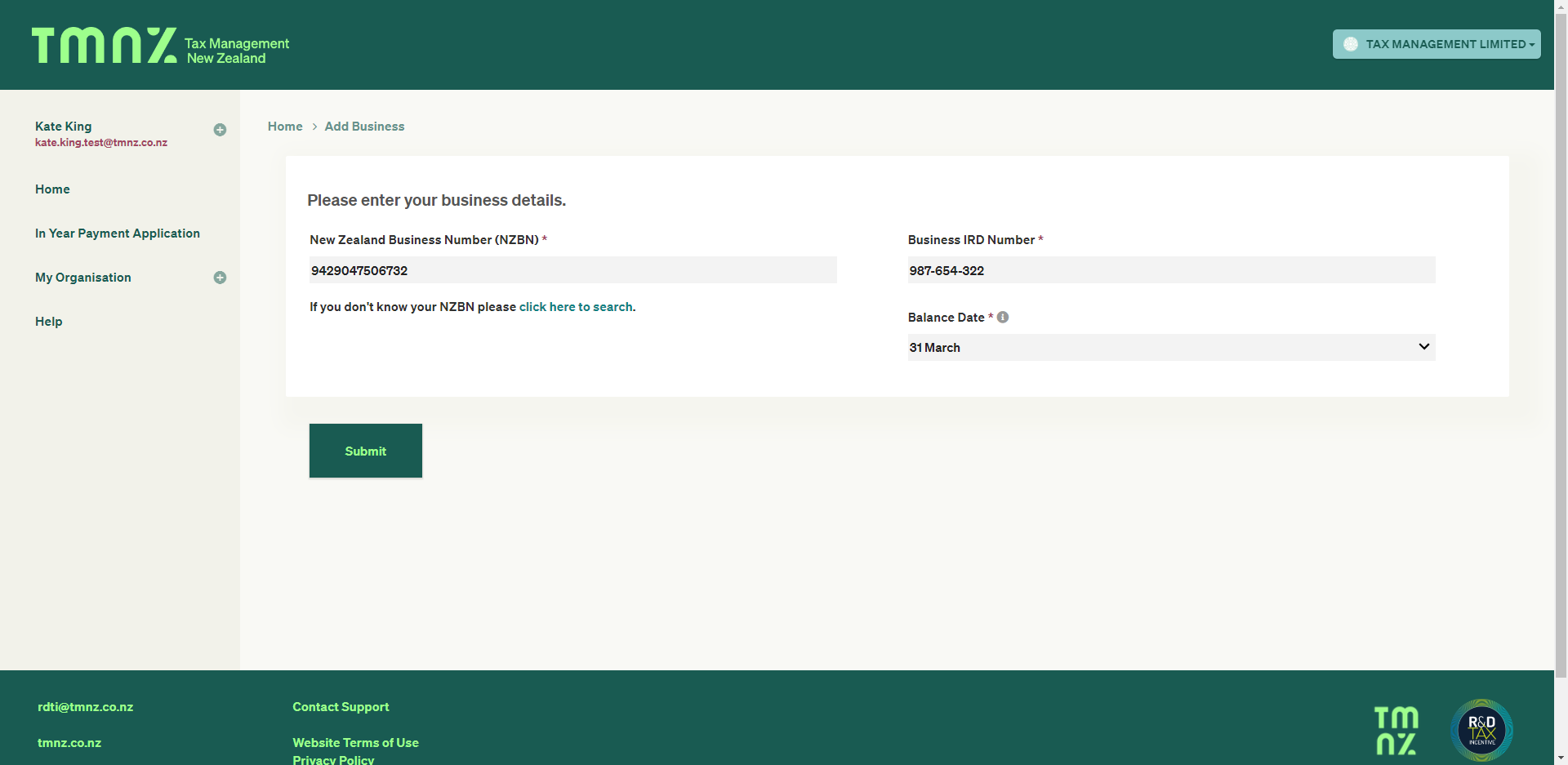

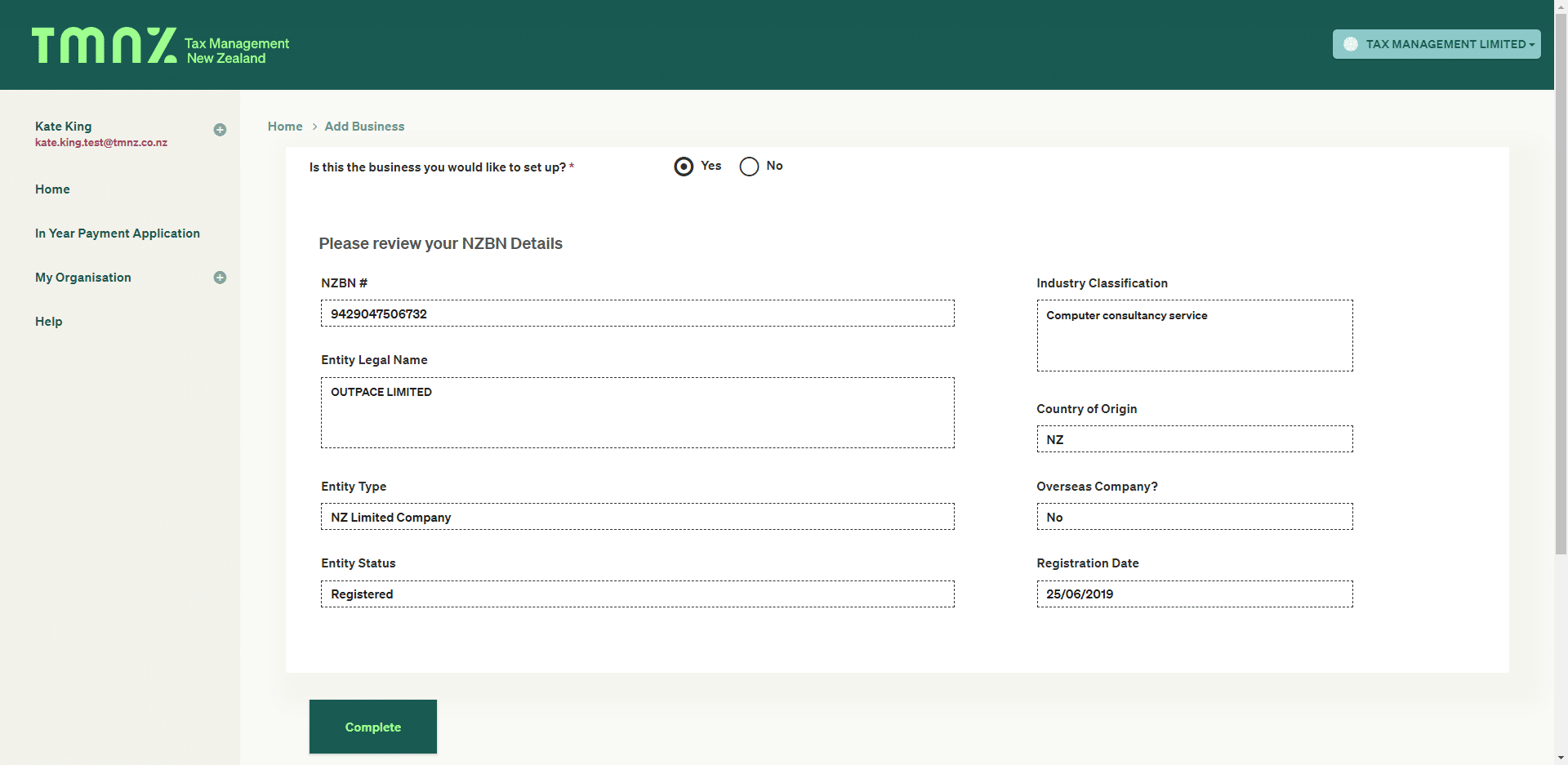

— Add Organisation

Simply select this option, fill in the required fields, and submit

This will take you to the next page to confirm if this is the business you want to set up. Select Yes and Complete to save the new organisation.

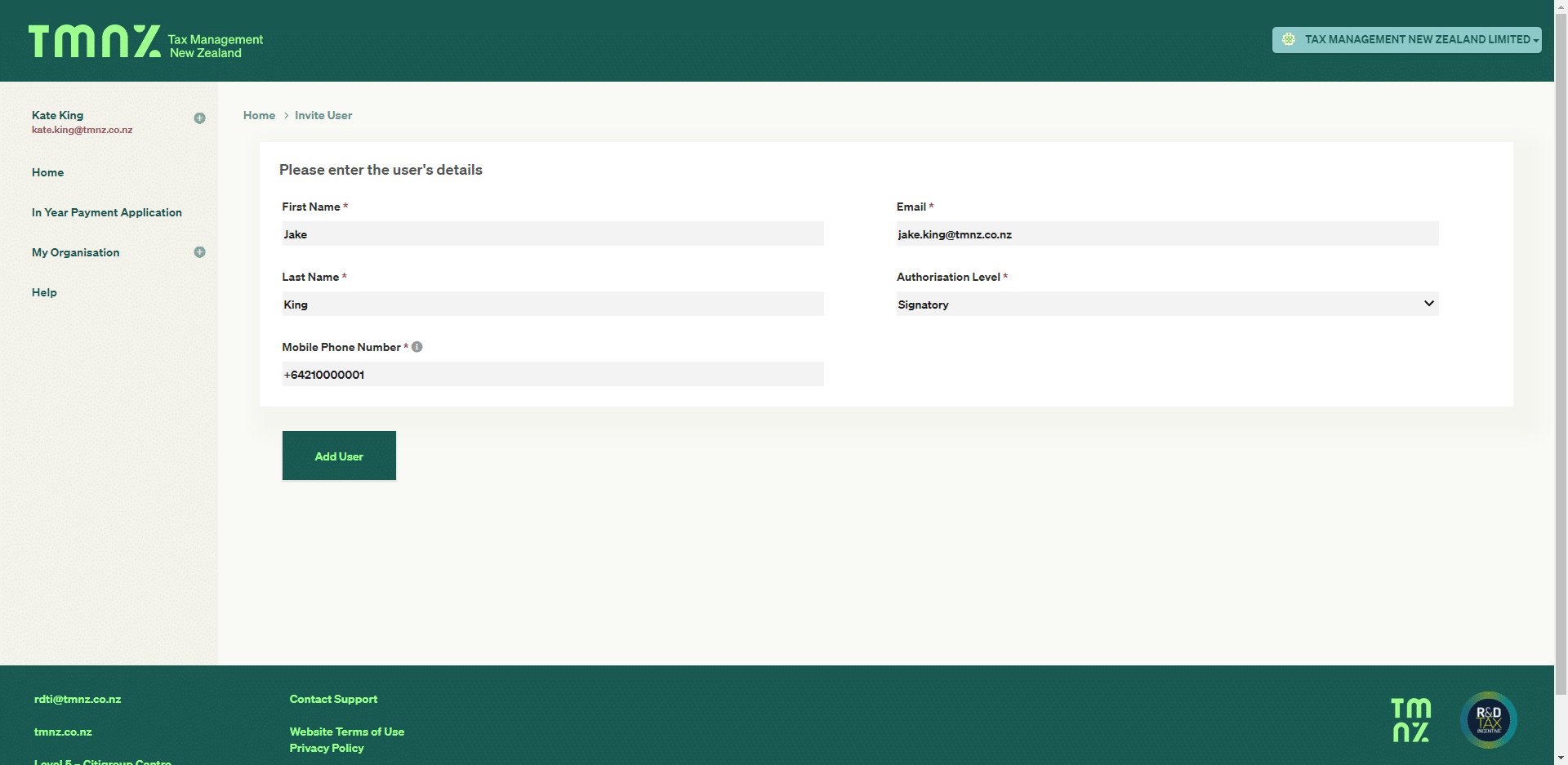

— Add a User

Select this option to be redirected to the My Organisations page. Select Invite User, complete the following fields and Add User.

— Updating your details

In the left-hand menu under your login email, select Update my details, make the appropriate changes, and Save User Details.

From the dashboard, you can access the application page in two ways. You can either click the Start Application menu in the quick links on your home screen or from the left menu, select In Year Payment Application

1.

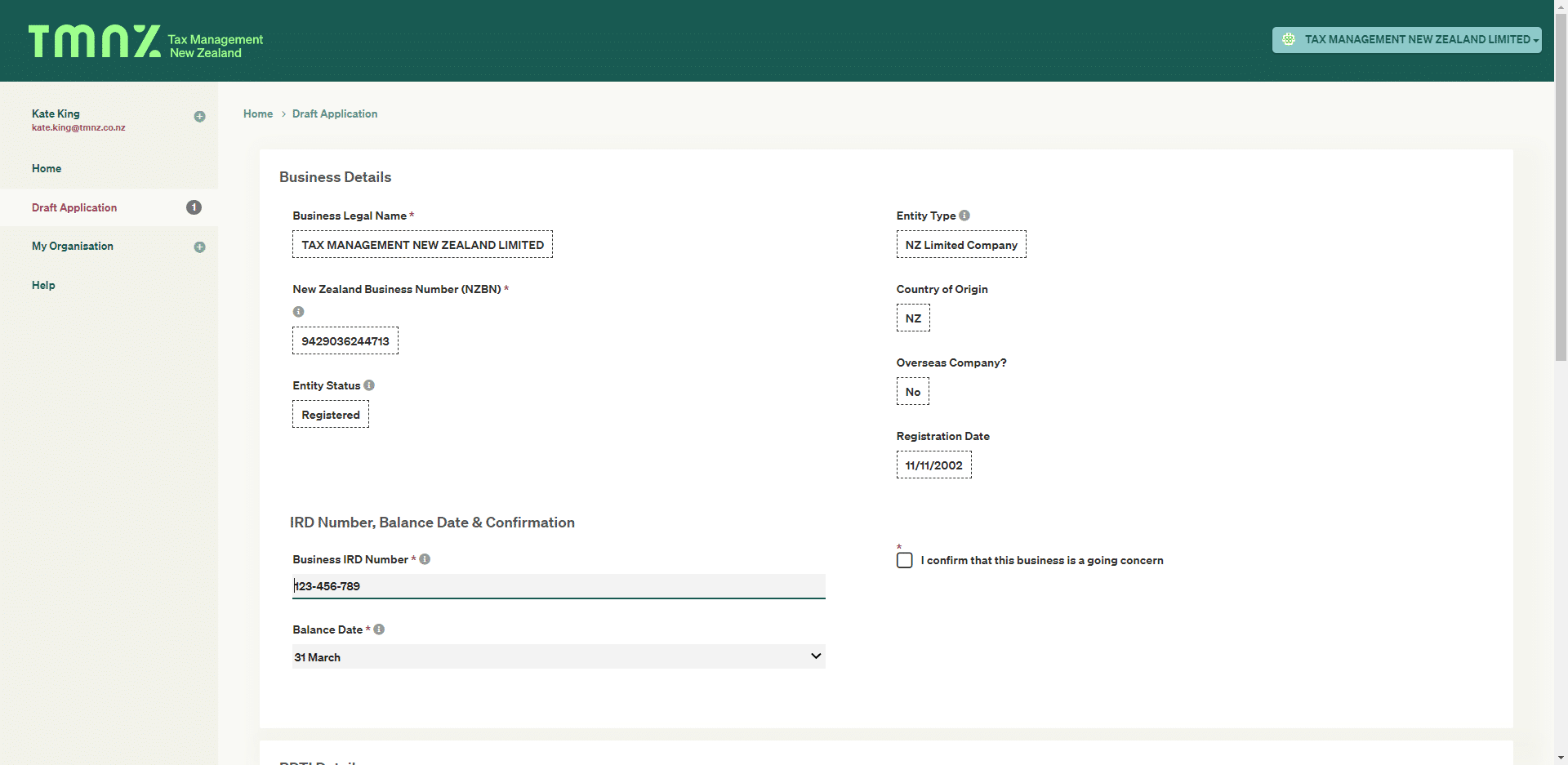

The first section of the form asks you to verify that all the business details are correct. You can alter the IRD number or balance date if necessary. Here, you also have to declare that the business is a going concern.

2.

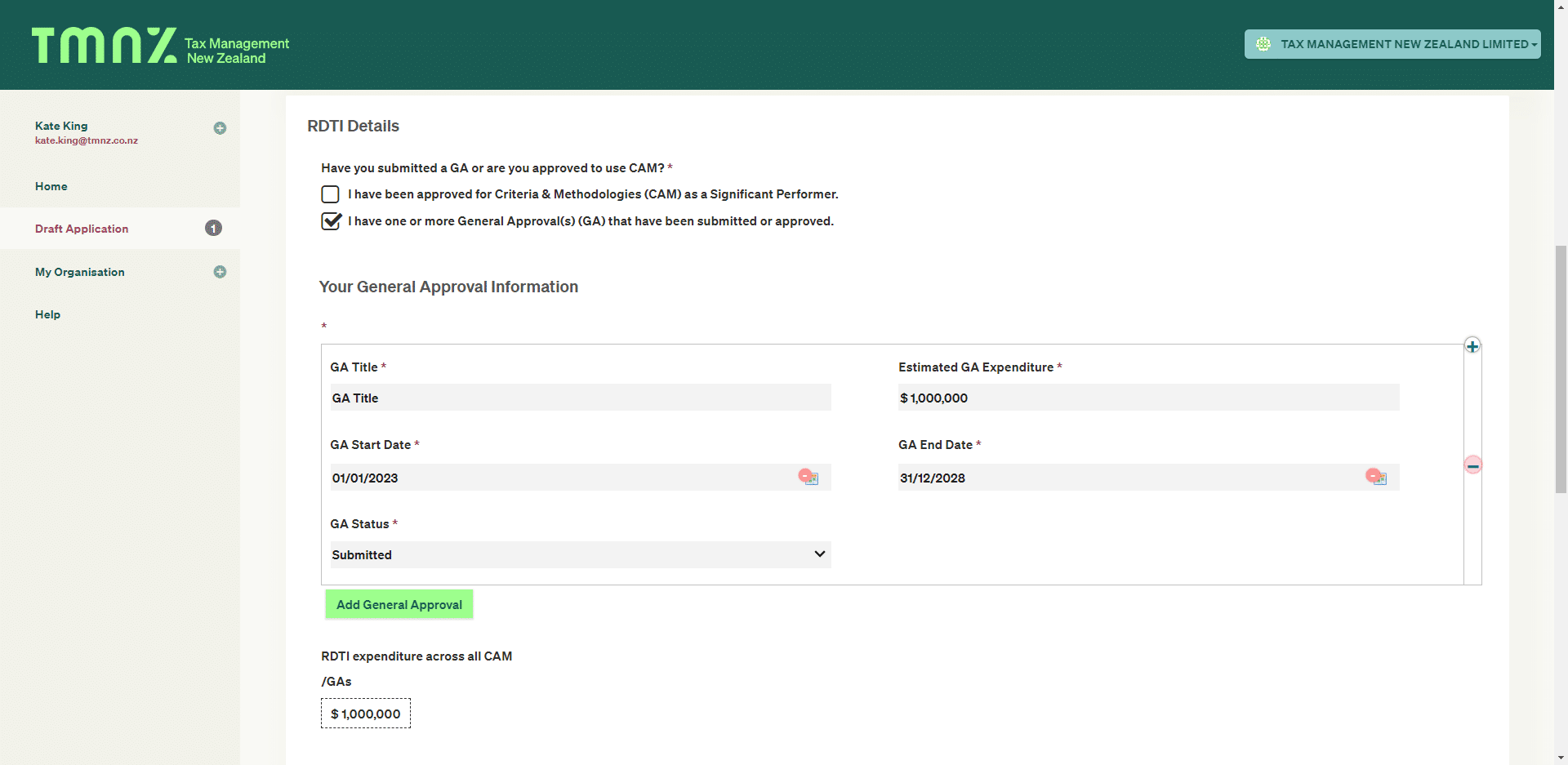

Enter all the details about your GA and/or CAM submission in the next section. Tick the appropriate option, and fill in the required information.

If you have more than one GA, select the Add General Approval to fill in the same fields for another GA under a different R&D project.

3.

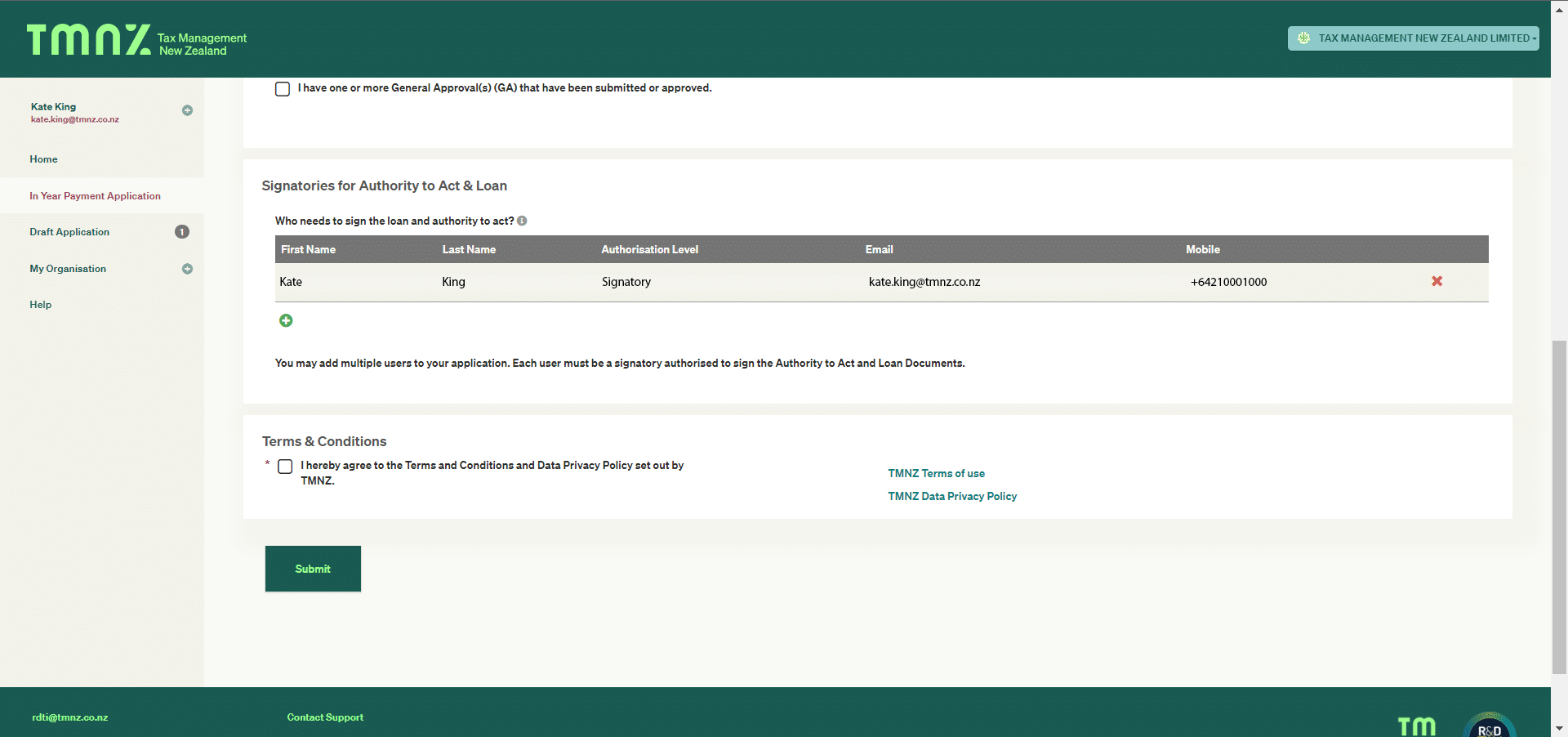

Once all GA or CAM information has been entered, answer the final section to confirm who needs to sign the loan and Authority to Act, and agree to our Terms and Conditions to complete the application. Please note that all contacts must be linked to the organisation. If they have not been added, select the User Management link to invite the user and include them in the application.

Following your application, TMNZ will conduct the due diligence checks in accordance with AML legislation. We use a third party, RealAML, to carry out the checks. RealAML will contact you to collect the required information.

To enable TMNZ to become an Other Representative on the company’s RDTI account within myIR, we will send all signatories a digital Authority to Act.

Upon completing these steps, a TMNZ RDTI specialist will work with the Ministry of Business and Innovation to review the application and provide the results to the business. Once your application has been accepted, you can request payments for any open periods.

Inland Revenue and MBIE use this mechanism to confirm CAM or GA details within your application. Inland Revenue also uses this mechanism to advise TMNZ when a business has completed its supplementary return to kickstart loan repayment (See When is my loan repayable? for more information).

Before your business details can be corrected, such as entity’s legal name, you will need to update the details via the New Zealand Companies Office Register

Yes, our team has the ability to action this. Please email us at rdti@tmnz.co.nz, letting us know about your situation.

Our team has the ability to action this. Please email us at rdti@tmnz.co.nz, letting us know about your situation.

There is no cut-off for in-year payment applications. You may apply at any time and request payments once you are approved.

You will be able to request up to 3 payments per income year. Our team will notify you when the cut-off for a particular payment date is approaching.

If you miss a particular payment date/s, you will be able to include expenditure prior to that date in a subsequent payment request for the same income year.

However, it will not be possible to carry forward expenditure from a previous income year to a subsequent income year.

The loan is due on whichever date below applies to you:

If you have filed your RDTI Supplementary Return by the due date, your loan is due on the earliest of the following dates:

- one month after IR has approved or declined your RDTI Supplementary Return, or

- six months after the due date of your RDTI Supplementary Return.

If you have NOT filed your RDTI Supplementary Return by the due date, your loan is due one month after the due date of your RDTI Supplementary Return.

The loan is interest-free up until one month after the relevant due date above.

If the loan is not repaid by the relevant due date:

- MBIE will charge interest on the loan from one month after the due date (at the IR “Use of Money” interest rate applicable at the time) and

- a standardised, short-term repayment plan will be arranged.

Tax pooling - a better way for 7 May

Tax pooling - a better way to manage 7 May

Thursday 27 April 2023

10:30am – 11:00am NZST (GMT+13)

0.5 CPD hours

Learn how tax pooling can eliminate the pressures and risks that come with the 7 May payment drain.

Tax pooling - a better way to manage 7 May

Thursday 27 April 2023

10:30am – 11:00am NZST (GMT+13)

0.5 CPD hours

Learn how tax pooling can eliminate the pressures and risks that come with the 7 May payment drain.

What you'll learn

- Market insights

- Structuring 7 May tax payments to suit your clients’ specific situations

- Managing the upcoming year’s tax obligations for your clients

- Best practice use of tax pooling in the current environment

Who this is for

This webinar is perfect for tax agents and accountants in public practice and counts towards 0.5 CPD hours (certificates will be provided). Your colleagues and connections are also welcome to join.

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions. Clyden has also previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

TMNZ and Xero

Tax pooling with TMNZ and Xero

Discover how easy it is to record tax pooling transactions into Xero and find out how this will benefit you and your clients.

Let our Director of Strategic Partnerships, Kathleen Payne, walk you through how it works or click below to learn more about tax pooling.

Learn more

about tax pooling

How to calculate provisional tax using the Standard Uplift Method and use tax pooling to avoid IR UOMI and late payment penalties

Current version available for download: October 2022

Previously published version(s): August 2019, February 2020

Looking for greater flexibility and certainty with your clients’ cashflow? Learn how tax pooling can help.

Current version available for download: October 2022

Previously published version(s): August 2019, February 2020

M2 WIN Kate Sylvester

Win a $1000 Kate Sylvester wardrobe

Renowned womenswear designer Kate Sylvester, co-founded Mindful Fashion New Zealand. TMNZ and Whakatupu Aotearoa Foundation are proud to support Mindful Fashion, the not-for-profit organisation focused on creating an innovative, full circle and thriving future for New Zealand’s fashion industry. Read our case study for more details here.

TMNZ is thrilled to offer you the opportunity to win beautiful, considered clothing of your choice from Kate Sylvester’s latest collection, up to the value of $1000.

Win a $1000 Kate Sylvester wardrobe

Renowned womenswear designer Kate Sylvester, co-founded Mindful Fashion New Zealand. TMNZ and Whakatupu Aotearoa Foundation are proud to support Mindful Fashion, the not-for-profit organisation focused on creating an innovative, full circle and thriving future for New Zealand’s fashion industry. Read our case study for more details here.

TMNZ is thrilled to offer you the opportunity to win beautiful, considered clothing of your choice from Kate Sylvester’s latest collection, up to the value of $1000.

Safe harbour

Safe harbour–what is it?

The safe harbour rule defines the threshold at which Inland Revenue use of money interest (UOMI) applies if income taxes for the year are underpaid.

Who does the safe harbour rule apply to?

The safe harbour rules in NZ apply to taxpayers with residual income tax (RIT) of less than $60,000, calculated using the standard uplift method. If a taxpayer meets the safe harbour criteria, Inland Revenue will only charge use of money interest on any unpaid taxes from the taxpayer’s terminal tax date onwards.

Current safe harbour rules in NZ

Before April 1 2022, taxpayers within the safe harbour threshold needed to pay their provisional taxes in full and on time. Inland Revenue removed this requirement from the beginning of the 2023 income year.

Taxpayers can also use the safe harbour rules during their first year of business when their residual income tax is less than $60,000.

This description is correct as of 27 February, 2023.

More useful tips and guides for paying tax

We’re here to support you with flexible and innovative tax solutions.

- Find a TMNZ Premium Partner for tax pooling advice

- Improve your cashflow with our Better Cashflow Management Guide

How to calculate provisional tax using the Standard Uplift Method and use tax pooling to avoid IR and late payment penalties

Our current guide was last updated in October 2022

Cashflow Guide

Better Cashflow Management

Managing cashflow is one of the biggest challenges that New Zealand businesses face. We’ve put together some tips and tricks to make it easier to ride those cashflow highs and lows through the year.

In this guide...

- Identify if you have a cashflow issue

- Common cashflow mistakes businesses make

- Cashflow tips and tricks including how to do a cashflow forecast, receive payments from customers faster, and ways to keep more cash in your business.

Current version available for download: October 2022

Previously published version(s): August 2019, February 2020

About this guide

In this guide, we provide some tips and tricks to improve your cashflow.

Including how to do a cashflow forecast, receive payments from customers faster, and simple ways you can keep more cash in your business.

Provisional Tax Guide

Guide: Provisional tax

[/movedo_title]

This guide outlines what every SME needs to know when talking about provisional tax with their accountant. If your business had to pay $2500 or more in income tax in the previous tax year, you are likely to be a provisional taxpayer. Due to the recent government response to COVID-19, we have updated the guide to reflect the new legislative changes. Read more on the COVID-19 tax proposal.

Current version available for download: April 2020

Previously published version(s): April 2019, August 2019

A brief explanation of what provisional tax is and who pays it. The following assumes it is not your first year in business and aligns with the provisional tax rules for the 2018 tax year onwards.

If this is your first year in business, refer to that chapter later in the guide as different rules apply.

Provisional tax breaks up the income tax you pay Inland Revenue (IR) by letting you pay it in instalments during the year instead of one big sum at the end of the tax year.

A taxpayer* may have to pay provisional tax when they earn income where tax is not deducted by the person or organisation from which it was received.

*Whether an individual, company or trust,

You may have to pay provisional tax if you:

- Run a business

- Are self-employed

- Engage in contract or freelance work

- Earn rental income

- Receive income from a partnership

- Earn money from overseas.

You would become a provisional taxpayer if the income tax due for the previous year (known as your residual income tax) was more than $2500. Your residual income tax is the amount of income tax you must pay, less any PAYE and other tax credits (except Working for Families) to which you are entitled.

Your tax year is based on your tax balance date. For most, it will be the period of 1 April to 31 March.