Stream - Tax Pooling – the Basics and Benefits

Tax Pooling – the Basics and Benefits

Learn how tax pooling works and discover the many ways it can help accountants and businesses better manage tax.

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions, and also having previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Registration - Tax Pooling – the Basics and Benefits

Tax Pooling – the Basics and Benefits

Wednesday 19 July 2023

10:30am – 11:00am

0.5 CPD hours

Learn how tax pooling works and discover the many ways it can help accountants and businesses.

Tax Pooling – the Basics and Benefits

Wednesday 19 July 2023

10:30am – 11:00am

0.5 CPD hours

Learn how tax pooling works and discover the many ways it can help accountants and businesses.

Overview

We’re pleased to invite you to our webinar, Tax Pooling – the Basics and Benefits. If you’re new to tax pooling, or need a refresher, join us 19 July to learn how tax pooling works and how it can help accountants and businesses better manage tax payments, with more freedom and cashflow flexibility.

What you'll learn

- the fundamentals of tax pooling and how it works

- all the benefits of tax pooling

- best practice uses of tax pooling in the current environment

- the important ways TMNZ can help accountants and businesses.

Who this is for

This webinar is perfect for:

- tax agents and accountants in public practice looking for an introduction to tax pooling, or wanting to refresh their knowledge

- business owners interested in using tax pooling to manage their tax with more freedom and cashflow flexibility.

It will count towards 0.5 CPD hours, and certificates will be provided. Your colleagues and connections are also welcome to join.

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions, and also having previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Tax Audits and Reassessments

Facing an IRD tax audit or reassessment?

TMNZ can help reduce costs on all types of reassessed tax arising from tax audits and voluntary disclosures.

Facing a tax audit or reassessment?

TMNZ can help reduce costs on all types of reassessed tax arising from tax audits and voluntary disclosures.

Facing a tax audit or reassessment?

TMNZ can help reduce costs on all types of reassessed tax arising from tax audits and voluntary disclosures.

Cover historical tax

TMNZ has the largest pool of audit tax in New Zealand. The oldest tax in our pool goes as far back as 2010, putting us in the best position for tax audit protection.

Save on interest

TMNZ can help you reduce interest costs on additional tax to pay and save on tax audit penalties following a tax reassessment.

No matter what tax you owe

We can help with all reassessed tax — PAYE, FBT, GST, NRWT, terminal tax and provisional tax. We’re experts at keeping your tax reassessment stress-free.

Cover historical tax

TMNZ has the largest pool of audit tax in New Zealand. The oldest tax in our pool goes as far back as 2010, putting us in the best position for tax audit protection.

Save on interest

TMNZ can help you reduce interest costs on additional tax to pay and save on audit penalties following a tax reassessment.

No matter what tax you owe

We can help with all reassessed tax — PAYE, FBT, GST, NRWT, terminal tax and provisional tax. We’re experts at keeping your tax reassessment stress-free.

Using tax pooling for a tax reassessment

We might be able to help with historical tax owing if:

- you’ve been through an IRD tax audit and found that you owe tax

- or you’re undertaking a voluntary disclosure and have discovered that you owe tax.

And:

- you apply to use tax pooling within 60 days of your tax reassessment.

In either case, you could save on interest by using tax in the pool. We can help with any type of tax, including PAYE, FBT, GST, NRWT, AIL, terminal tax, and provisional tax.

What we'll need

To help you with a tax reassessment, there are two things you need to know:

- the amount of tax you owe following the reassessment

- the date of the reassessment.

If you’re unsure where to find this information, we can help. Get in touch.

Tax Audit FAQs

A tax reassessment arises when Inland Revenue adjusts a previous tax return to increase (or sometime decrease) the amount of tax you owe. It can follow from Inland Revenue reviewing your past tax returns or carrying out a full audit of your tax affairs. It can also arise where you have made a voluntary disclosure to Inland Revenue to correct a tax position that you have previously taken.

Where Inland Revenue issues a reassessment of a prior tax period that results in you having to pay more tax, you may be able to use tax pooling to help you pay your reassessed tax.

Inland Revenue will charge you interest on the reassessed tax, dating back to the period when the tax was originally due. TMNZ can reduce the interest costs, and give you more time to pay the reassessed tax.

New Zealand’s tax pooling rules allow for pooling to be used to meeting increased tax liabilities across most tax types, including income tax (provisional and terminal tax), PAYE, FBT, GST, NRWT, ESCT, and AIL.

A voluntary tax disclosure is when you choose to tell Inland Revenue about mistakes with your tax affairs. Any person or business liable for paying tax can make a voluntary tax disclosure. Even if you have already received a tax audit notice, you can still make a voluntary tax disclosure. This can be done in the initial interview stage or during the inspection of your records.

Making a voluntary tax disclosure can save you on penalty charges. In many cases, penalties on any tax shortfall can be reduced by 75% or even 100%.

You are better off making a voluntary disclosure than waiting for Inland Revenue to find inconsistencies with your tax payments.

Never miss a tax deadline

Pay your provisional tax on time, every time.

See upcoming provisional and terminal tax dates with TMNZ’s free calendar.

Login - NZ Budget 2023

NZ Budget 2023 – review with Tony Alexander

Our speakers

Tony Alexander, Independent Economist

Tony is a renowned economics analyst and commentator in New Zealand. He worked for BNZ for 26 years, 25 of which were as Chief Economist. His focus has always been on translating developments and trends in the economics sphere into a language that people can understand, aiming to help New Zealanders make better decisions for their businesses, investments, home purchases, and people.

Chris Cunniffe, CEO, TMNZ

Chris has been leading TMNZ as CEO for over 10 years. He was made a CA ANZ Fellow in 2019 and has been on the CAANZ Tax Advisory Group for more than 20 years. Before TMNZ, Chris was Head of Tax at Air New Zealand and Bank of New Zealand.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Stream - NZ Budget Review with Tony Alexander

NZ Budget Review — with Tony Alexander

Our speakers

Tony Alexander, Independent Economist

Tony is a renowned economics analyst and commentator in New Zealand. He worked for BNZ for 26 years, 25 of which were as Chief Economist. His focus has always been on translating developments and trends in the economics sphere into a language that people can understand, aiming to help New Zealanders make better decisions for their businesses, investments, home purchases, and people.

Chris Cunniffe, CEO, TMNZ

Chris has been leading TMNZ as CEO for over 10 years. He was made a CA ANZ Fellow in 2019 and has been on the CAANZ Tax Advisory Group for more than 20 years. Before TMNZ, Chris was Head of Tax at Air New Zealand and Bank of New Zealand.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Stream - Tax pooling - a better way for 7 May

Tax pooling - a better way to manage 7 May

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions. Clyden has also previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Login - Tax pooling - a better way for 7 May

Tax pooling - a better way to manage 7 May

Our speakers

Clyden Manikkam, Director of Strategy and Sales, TMNZ

Clyden is responsible for the commercial direction and outcomes for TMNZ. He has a strong tax and commercial background, having held senior roles at IRD primarily involved in investigations and prosecutions. Clyden has also previously managed businesses in the private sector.

Kathleen Payne, Director of Strategic Partnerships, TMNZ

Kathleen brings a wide range of experience in tax and accounting from positions held in both top tier and smaller accounting firms, as well as experience in a corporate tax environment. She values client relationships and enabling others to succeed with business solutions and training.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

Innovative Tax Technology

Our technology makes tax time easy

Save time on compliance and bring your clients more value with TMNZ’s tax technology, dashboard features and integrations with other leading FinTechs.

Our technology makes tax time easy

Save time on compliance and bring your clients more value with TMNZ’s tax technology, dashboard features and integrations with other leading FinTechs.

Tax Tech

Get real-time access to client tax information, automate compliance reporting, and streamline communication. Direct IRD connectivity removes manual data entry, reduces errors, and keeps your practice working with the most current data for decisions and advisory.

Make your life easier

- Instant access to IRD data for faster reviews and filings

- Automated reporting that cuts admin and error risk

- More time for higher-value advisory and planning

Why your clients will love it

- Faster turnaround and more accurate advice

- Fewer processing delays and fewer corrections

- Better cashflow management with timely insights

Ideal for

- High-volume practices

- Firms seeking automation and compliance efficiencies

- Teams that need real-time taxpayer data

Direct connection to IRD; instant access, zero delays, maximum accuracy.

Connect once and work from one place. TMNZ transactions appear in your TaxLab dashboard with automatic sync, so double entry drops away, reporting is clearer, and reviews move faster, freeing up more time for advisory. With our integration, you can easily generate tax pooling quotes directly from TaxLab as well as send provisional tax reminders to your clients using our tax pooling products, to optimise your workflow.

Make your life easier

- Plan and line payments up with how the business earns

- Place deposits when it helps most and avoid unnecessary costs

- Demonstrate cashflow expertise beyond basic compliance

Why your clients will love it

- Turn surplus cash into future tax credits

- Reduce pressure at peak payment times and year end

- Maintain flexibility with a steadier cash position across the year

Ideal for

- Profitable businesses with strong cashflow

- Companies seeking proactive tax planning

- Organisations with seasonal peak

Keep the TaxLab interface you know and add more power where it counts.

We’re working closely with all major tax technology providers in New Zealand as well as innovative FinTech to provide the best, seamless experience when using multiple products to manage your tax and financial matters. We collaborate with organisations like Xero, CCH, Wolters Kluwer, MYOB and others to make services across the industry more accessible. Talk to us about new integrations or products that you would like to see on your TMNZ dashboard.

Product Features

Group Optimiser

Group Optimiser lets you manage group tax positions from a single dashboard. Enter details for each entity once, calculate positions across multiple taxpayers, and generate the required transactions in one pass.

Tax Calculator

Work out your tax instantly across scenarios, entity types, and obligations with our tax calculator. Handle provisional and terminal tax, penalty calculations, and multi-year projections to support real-time planning and scenario analysis throughout the year.

Upcoming Deadlines

Track every tax deadline across your client base in one place. The Upcoming Deadlines system monitors multiple obligation types, prioritises upcoming tax dates, and enables you to send reminders, so nothing is missed and workflows run efficiently.

Automated Tax Swaps

Reallocate tax obligations between entities and periods to optimise overall positions. Adjust timing, refine entity use, and transfer obligations where appropriate to improve cashflow and reduce the total tax burden, while remaining fully compliant.

Learn more about our product features, including video walkthroughs and FAQs, on our Support Site.

Speak to our dedicated team to tax experts today

If you want to understand more about how our innovative tax technology can help you, or you’re looking to set up one of the integrations or features mentioned here, please get in touch.

Budget 2023 - review with Tony Alexander

Budget 2023 - review

with Tony Alexander

Friday 19 May

10am – 11am

Join our NZ Budget 2023 Review with Tony Alexander, the morning following the Government’s big announcements. As one of New Zealand’s leading economists, Tony will be sharing key takeaways from Budget 2023 and his expert view on New Zealand’s economic outlook.

Budget 2023 - review with Tony Alexander

Friday 19 May

10am – 11am

Join our NZ Budget 2023 Review with Tony Alexander, the morning following the Government’s big announcements. As one of New Zealand’s leading economists, Tony will be sharing key takeaways from Budget 2023 and his expert view on New Zealand’s economic outlook.

What we'll cover

- What does Budget 2023 mean for New Zealand’s economy and businesses?

- How is Budget 2023 going to help the cost of living challenges?

- The big Budget 2023 tax implications, co-presented with Chris Cunniffe, TMNZ CEO

- As well as Q&A

Who this is for

This online seminar is for our tax agents and accountants to gain insights on how the Government’s 2023 Budget will impact their business and their clients. Your colleagues and connections are also welcome to join.

Our speakers

Tony Alexander, Independent Economist

Tony is a renowned economics analyst and commentator in New Zealand. He worked for BNZ for 26 years, 25 of which were as Chief Economist. His focus has always been on translating developments and trends in the economics sphere into a language which people can understand, aiming to help kiwis make better decisions for their businesses, investments, home purchases, and people.

Chris Cunniffe, CEO, TMNZ

Chris has been leading TMNZ as CEO for over 10 years. He was made a CA ANZ Fellow in 2019 and has been on the CAANZ Tax Advisory Group for more than 20 years. Before TMNZ, Chris was Head of Tax at Air New Zealand and Bank of New Zealand.

Book a tax pooling overview for your business

Is tax pooling the right solution for you? Every business we work with has different needs. Book an overview with one of our tax pooling specialists to find out how we can support you.

RDTI help

RDTI in-year payments help

RDTI tax credits are issued to participating businesses after they have filed their income tax return and their RDTI Supplementary Return has been processed. This can mean a business may not receive their credit until 12-18 months after the end of the income year during which their R&D was conducted.

The RDTI in-year payments scheme is designed to help businesses performing eligible R&D receive cash support closer to when they incur the corresponding R&D costs. This cash support is in the form of an interest-free Government loan.

The business must meet the following criteria to qualify for in-year payments:

- The customer has applied for RDTI by having CAM, GA, or submitting their GA through Inland Revenue and

- your business is a going concern and

- The client has no outstanding matured RDTI in-year payments from the previous income year (not applicable to the first year).

If you have not yet submitted your GA or CAM application, you can contact Callaghan Innovation’s team, who can provide free assistance until the business’ GA/CAM submission: https://www.rdti.govt.nz/we-provide-free-tailored-support/.

RDTI in-year payments are administered by Tax Management New Zealand (TMNZ). After applying for RDTI, you can create an account to begin in-year payments. Once you have logged in and entered all of the required information to onboard, then we will collect information about your RDTI submission, conduct Anti-Money Laundering (AML) and Due Diligence (DD) checks, and seek permission to access the business’ RDTI Account

A TMNZ RDTI specialist will work with the Ministry of Business, Innovation and Employment (MBIE) to review the application. MBIE holds all decision-making authority for the scheme. Once your application has been accepted, you can request payments for any open periods.

We will announce details on how people can request payments and how loan repayments work soon.

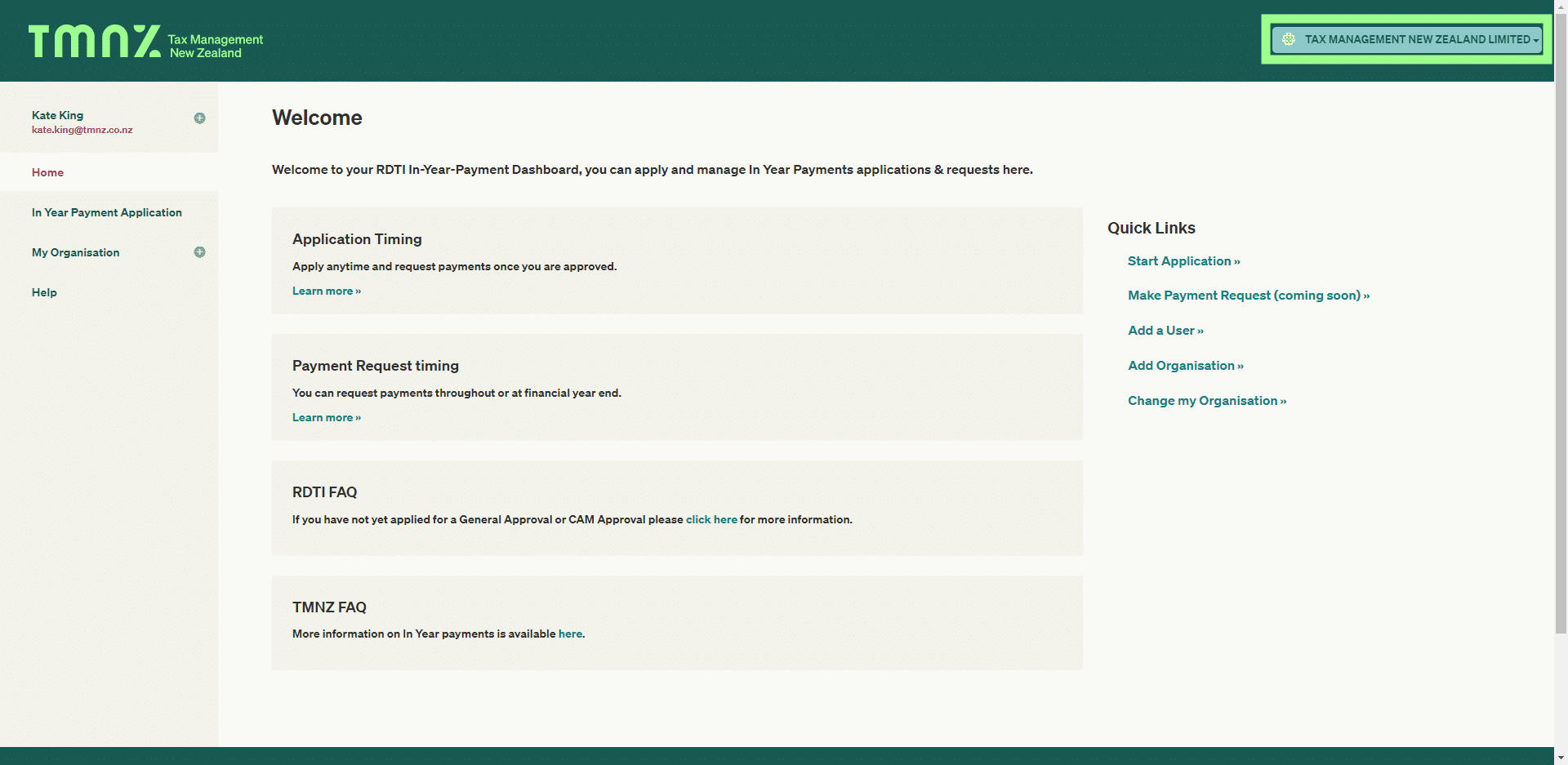

After completing the onboarding process, you will have access to your registered organisation’s dashboard.

Your Organisation

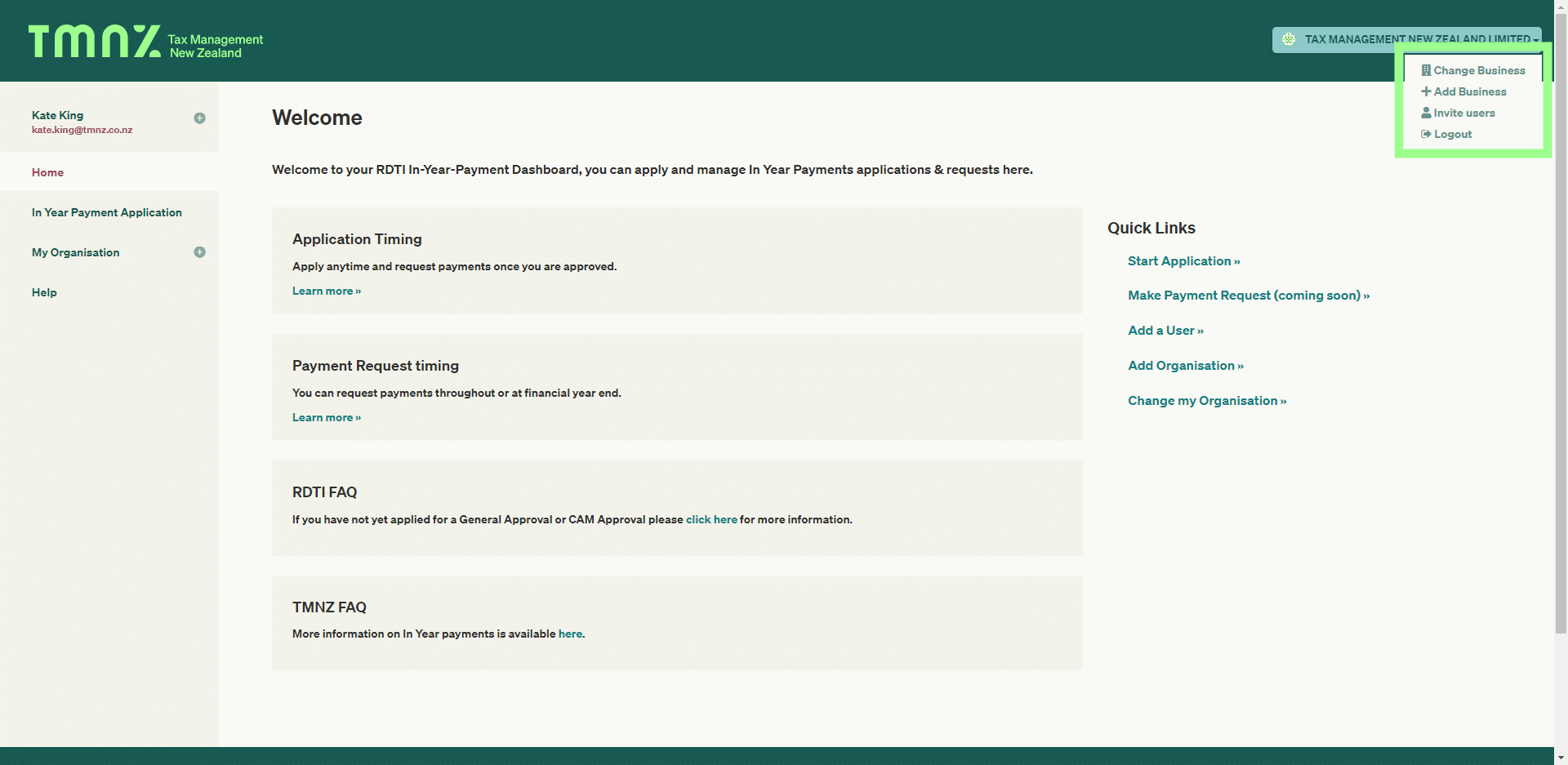

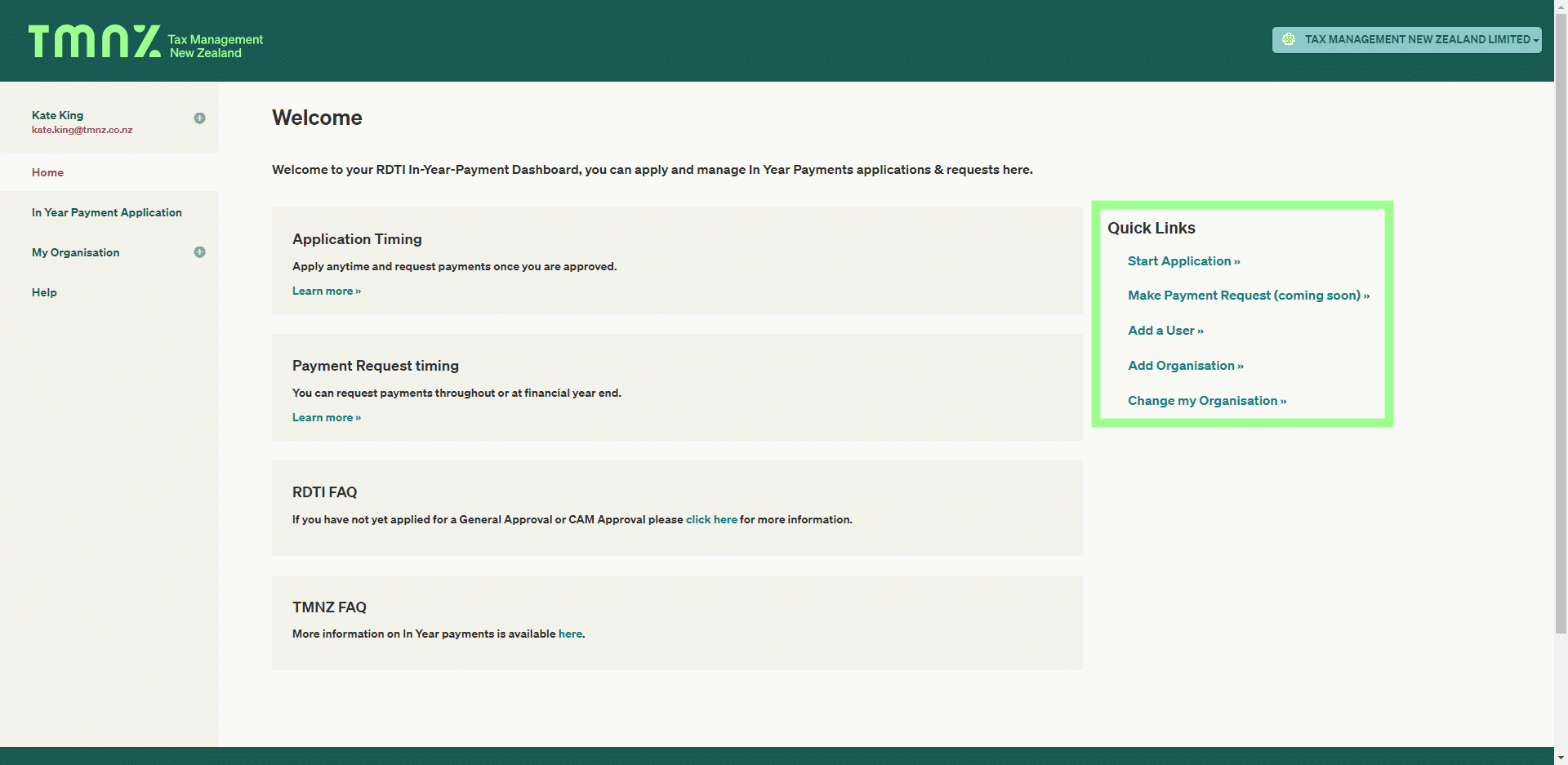

You can access all the options related to an organisation by clicking on the name at the top right of the page.

Quick Link Option

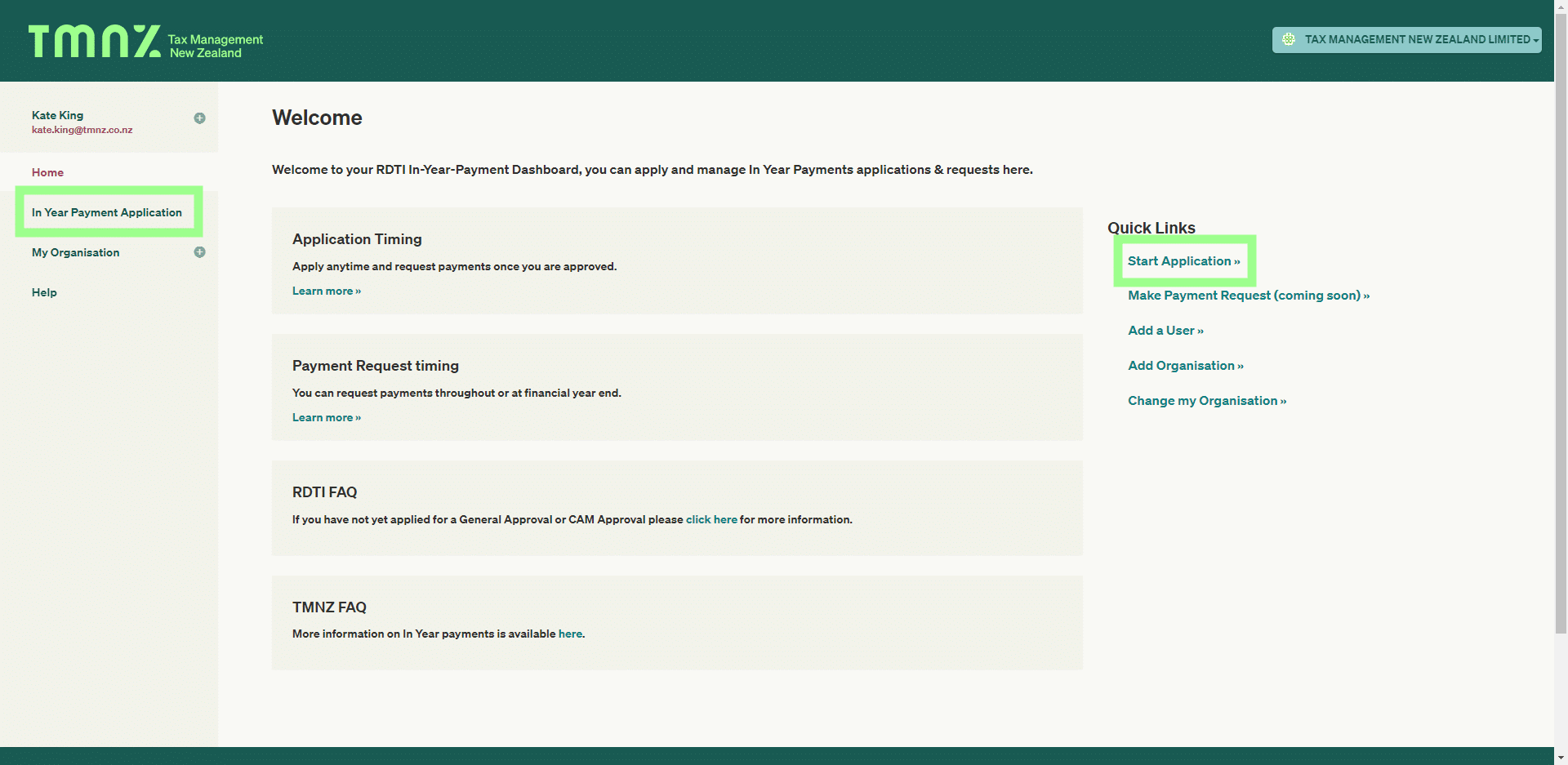

You can access this content on the right-hand side of your home screen. These options provide everything you can manage with your login. You can create a new business, invite other users to access the organisation’s RDTI in-year payment content, log in as another business or begin your application.

Let’s look at these options:

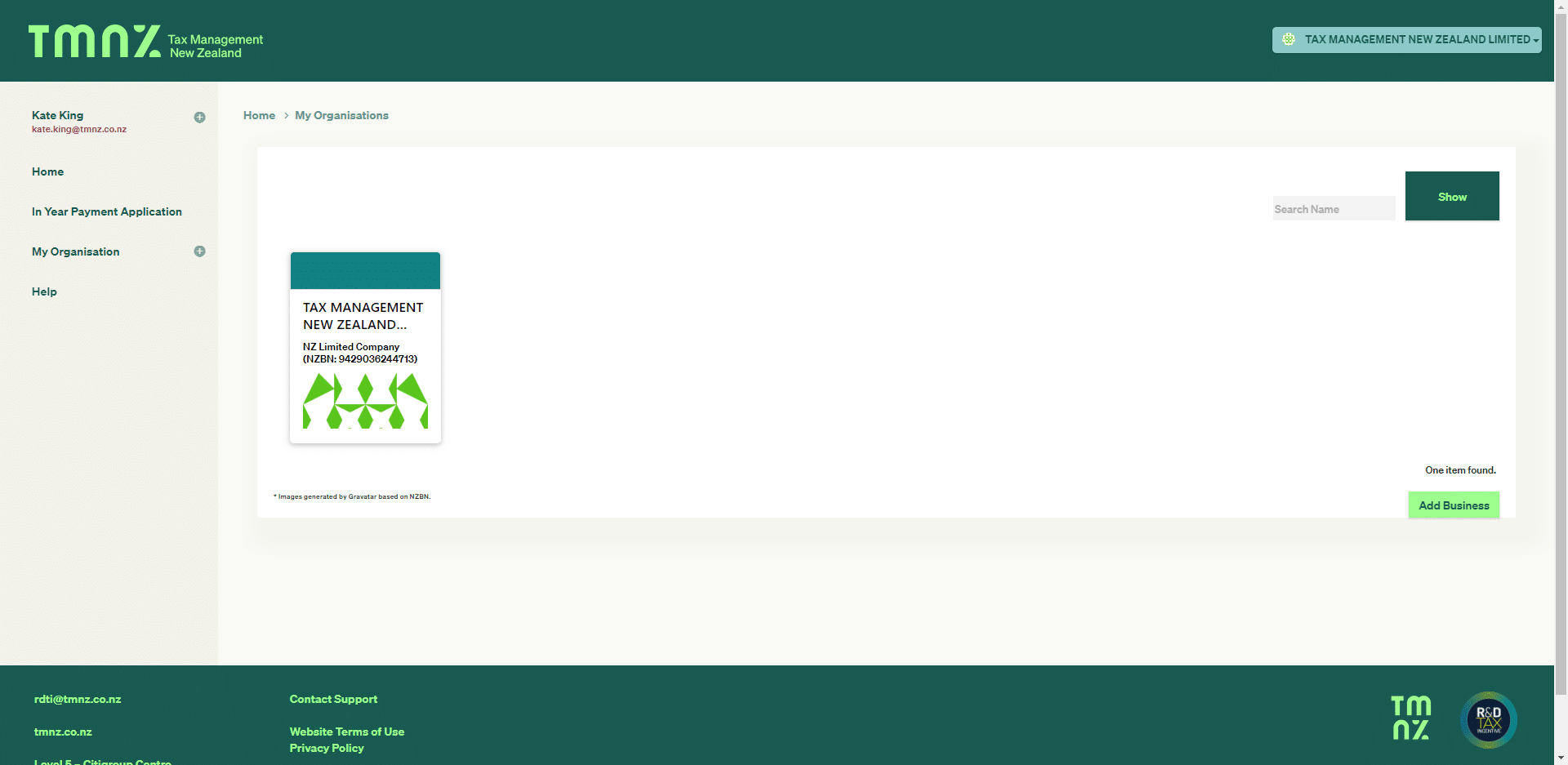

— Change my Organisation

Select this option to manage in-year payments with a different organisation. Once you are on the My Organisations page, click on the organisation you want to log in as.

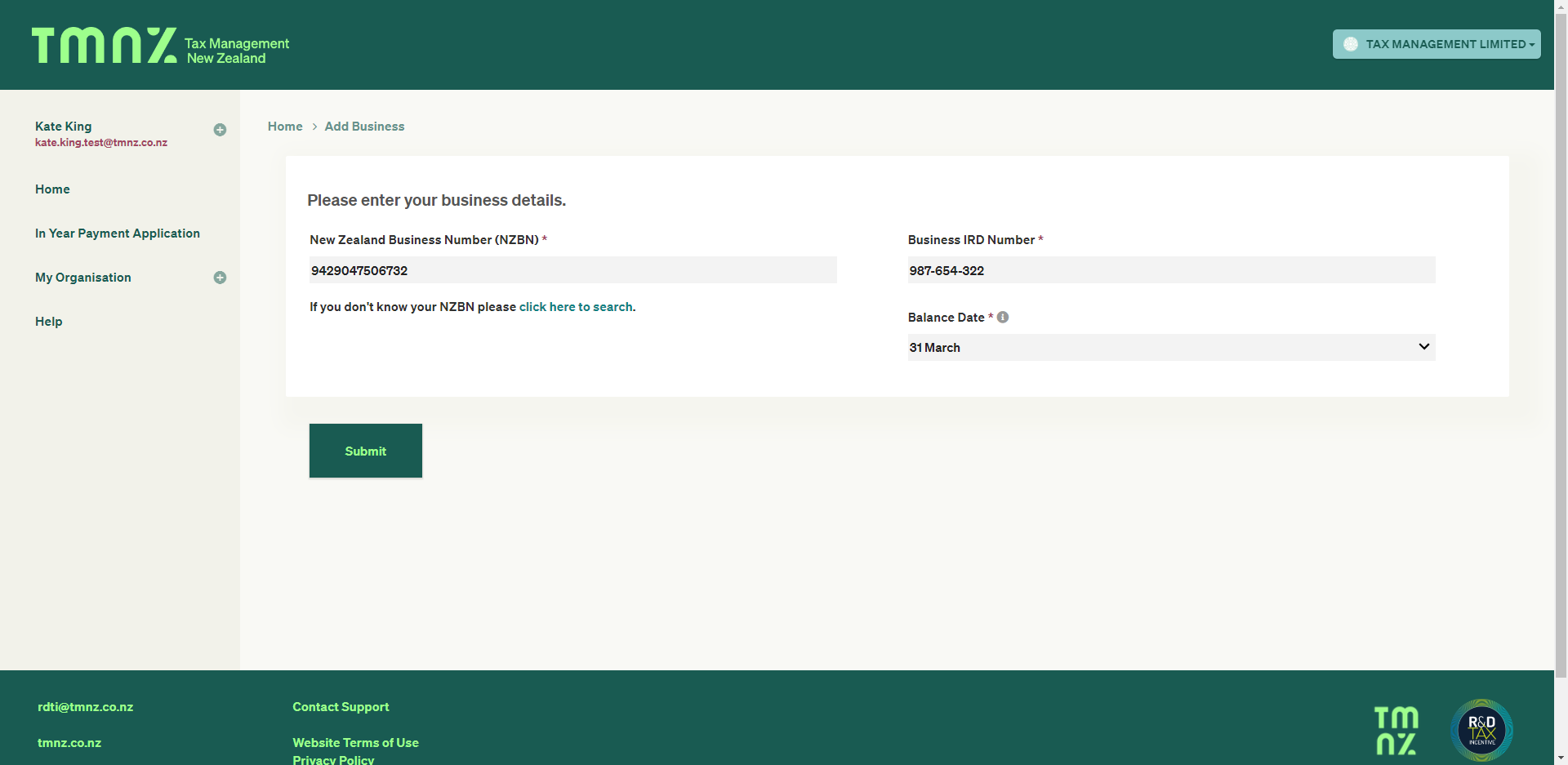

— Add Organisation

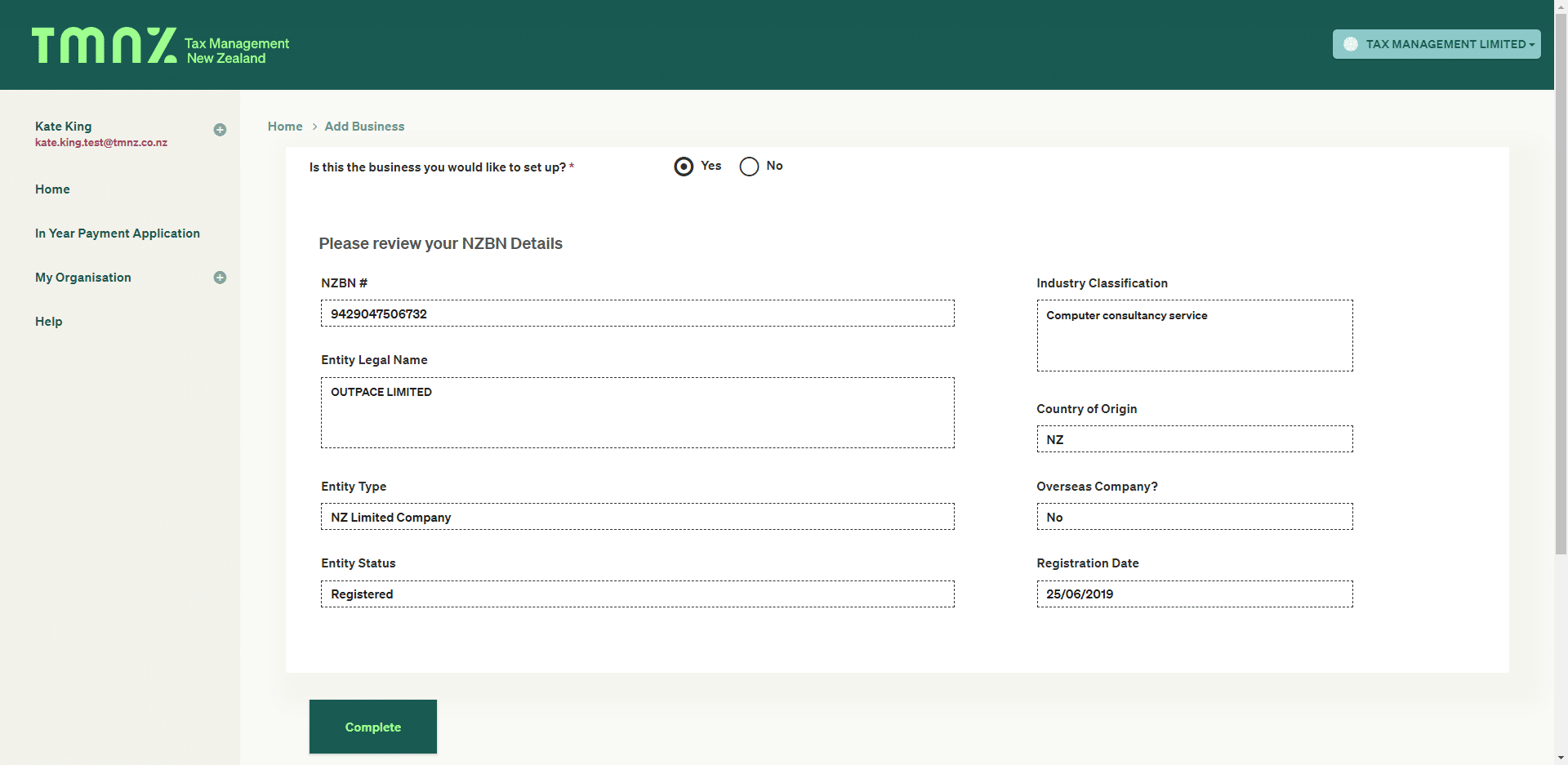

Simply select this option, fill in the required fields, and submit

This will take you to the next page to confirm if this is the business you want to set up. Select Yes and Complete to save the new organisation.

— Add a User

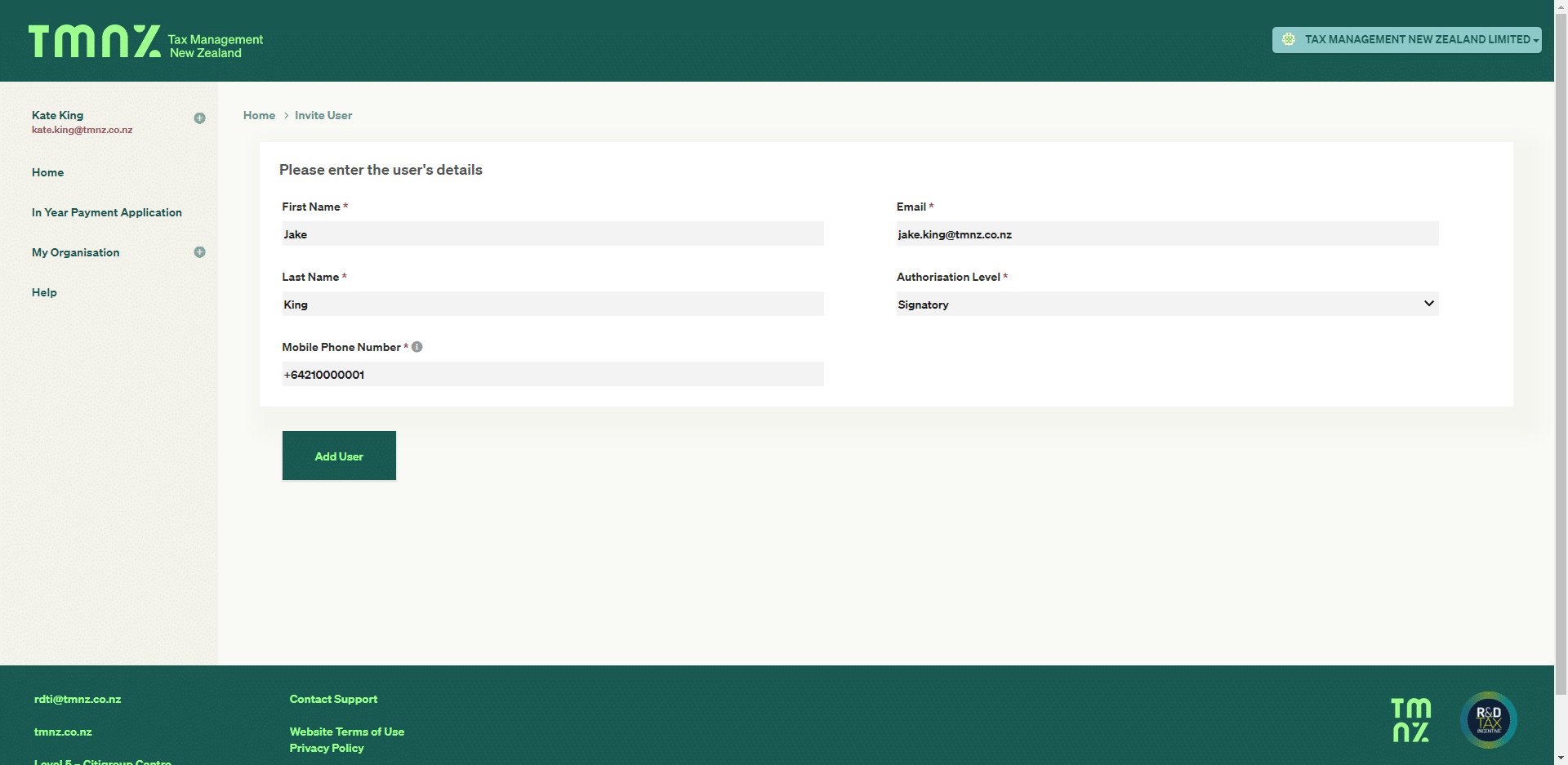

Select this option to be redirected to the My Organisations page. Select Invite User, complete the following fields and Add User.

— Updating your details

In the left-hand menu under your login email, select Update my details, make the appropriate changes, and Save User Details.

From the dashboard, you can access the application page in two ways. You can either click the Start Application menu in the quick links on your home screen or from the left menu, select In Year Payment Application

1.

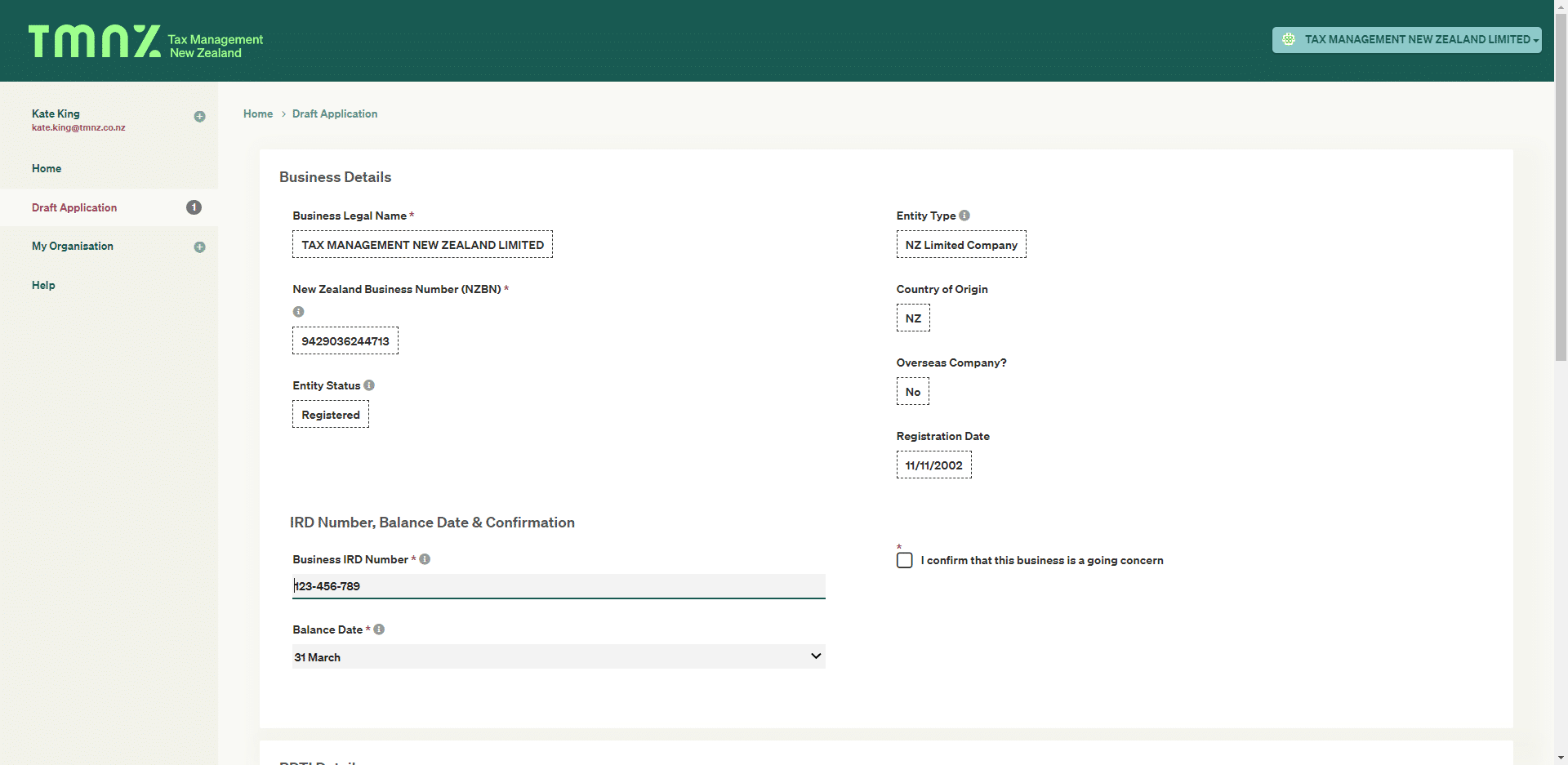

The first section of the form asks you to verify that all the business details are correct. You can alter the IRD number or balance date if necessary. Here, you also have to declare that the business is a going concern.

2.

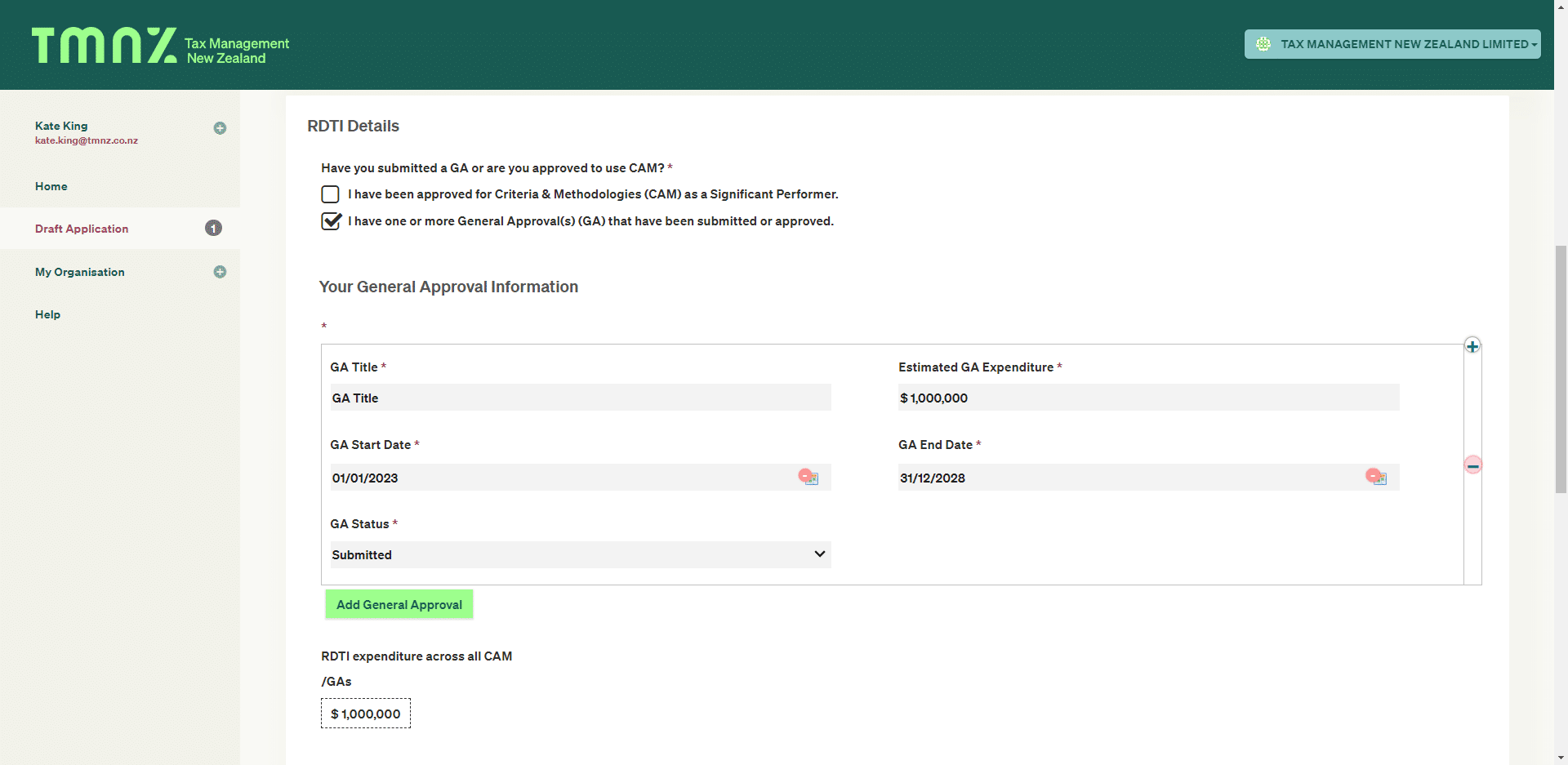

Enter all the details about your GA and/or CAM submission in the next section. Tick the appropriate option, and fill in the required information.

If you have more than one GA, select the Add General Approval to fill in the same fields for another GA under a different R&D project.

3.

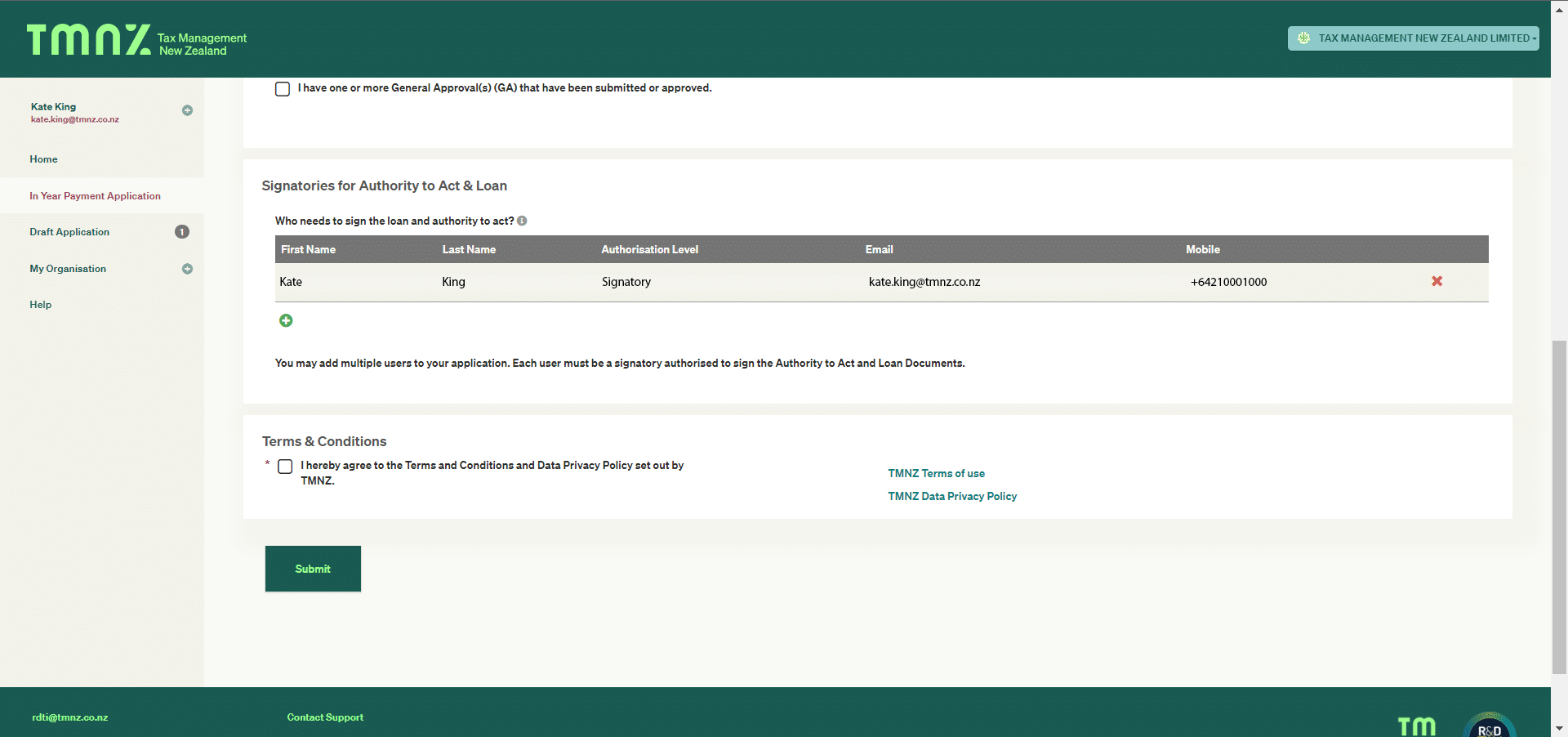

Once all GA or CAM information has been entered, answer the final section to confirm who needs to sign the loan and Authority to Act, and agree to our Terms and Conditions to complete the application. Please note that all contacts must be linked to the organisation. If they have not been added, select the User Management link to invite the user and include them in the application.

Following your application, TMNZ will conduct the due diligence checks in accordance with AML legislation. We use a third party, RealAML, to carry out the checks. RealAML will contact you to collect the required information.

To enable TMNZ to become an Other Representative on the company’s RDTI account within myIR, we will send all signatories a digital Authority to Act.

Upon completing these steps, a TMNZ RDTI specialist will work with the Ministry of Business and Innovation to review the application and provide the results to the business. Once your application has been accepted, you can request payments for any open periods.

Inland Revenue and MBIE use this mechanism to confirm CAM or GA details within your application. Inland Revenue also uses this mechanism to advise TMNZ when a business has completed its supplementary return to kickstart loan repayment (See When is my loan repayable? for more information).

Before your business details can be corrected, such as entity’s legal name, you will need to update the details via the New Zealand Companies Office Register

Yes, our team has the ability to action this. Please email us at rdti@tmnz.co.nz, letting us know about your situation.

Our team has the ability to action this. Please email us at rdti@tmnz.co.nz, letting us know about your situation.

There is no cut-off for in-year payment applications. You may apply at any time and request payments once you are approved.

You will be able to request up to 3 payments per income year. Our team will notify you when the cut-off for a particular payment date is approaching.

If you miss a particular payment date/s, you will be able to include expenditure prior to that date in a subsequent payment request for the same income year.

However, it will not be possible to carry forward expenditure from a previous income year to a subsequent income year.

The loan is due on whichever date below applies to you:

If you have filed your RDTI Supplementary Return by the due date, your loan is due on the earliest of the following dates:

- one month after IR has approved or declined your RDTI Supplementary Return, or

- six months after the due date of your RDTI Supplementary Return.

If you have NOT filed your RDTI Supplementary Return by the due date, your loan is due one month after the due date of your RDTI Supplementary Return.

The loan is interest-free up until one month after the relevant due date above.

If the loan is not repaid by the relevant due date:

- MBIE will charge interest on the loan from one month after the due date (at the IR “Use of Money” interest rate applicable at the time) and

- a standardised, short-term repayment plan will be arranged.