Partnership with ATAINZ

March 29, 2021 — TMNZ today announces a partnership with The Accountants and Tax Agents Institute of New Zealand (ATAINZ). The partnership will advance TMNZ's ambition to accelerate the adoption of tax pooling solutions amongst taxpayers who would benefit from genuine provisional tax flexibility. In addition, TMNZ is announcing plans to commence offers and opportunities via the ATAINZ membership.

ATAINZ members will be able to look forward to the collaboration between TMNZ and ATAINZ. Starting from Q2 2021, ATAINZ members will have available tax pooling training, collateral options, and an ATAINZ point of contact at TMNZ.

Richard Abel, Chairperson of ATAINZ said: “Having been a user and supporter of tax pooling through TMNZ for a number of years, we’re excited to formalise an agreement with TMNZ for all our members. Signing the partnership with TMNZ affirms our commitment to being recognised as the voice of small-medium businesses (SME) in New Zealand. Tax pooling presents a cashflow solution that more should be aware of.”

Neil Bhattacharya, Head of Client Services at TMNZ said: “ATAINZ is a progressive organisation that is growing quickly and TMNZ is looking forward to partnering with them for the next 3 years and beyond. We feel strongly that tax pooling is a key cashflow tool for SMEs and a perfect match for ATAINZ clients looking for cashflow options.”

About ATAINZ

The Accountants and Tax Agents Institute of New Zealand (ATAINZ) exists to promote the welfare and professional development of its members and to represent members' interests in New Zealand. It is unique in the New Zealand tax and accounting market because of its grassroots contact with members.

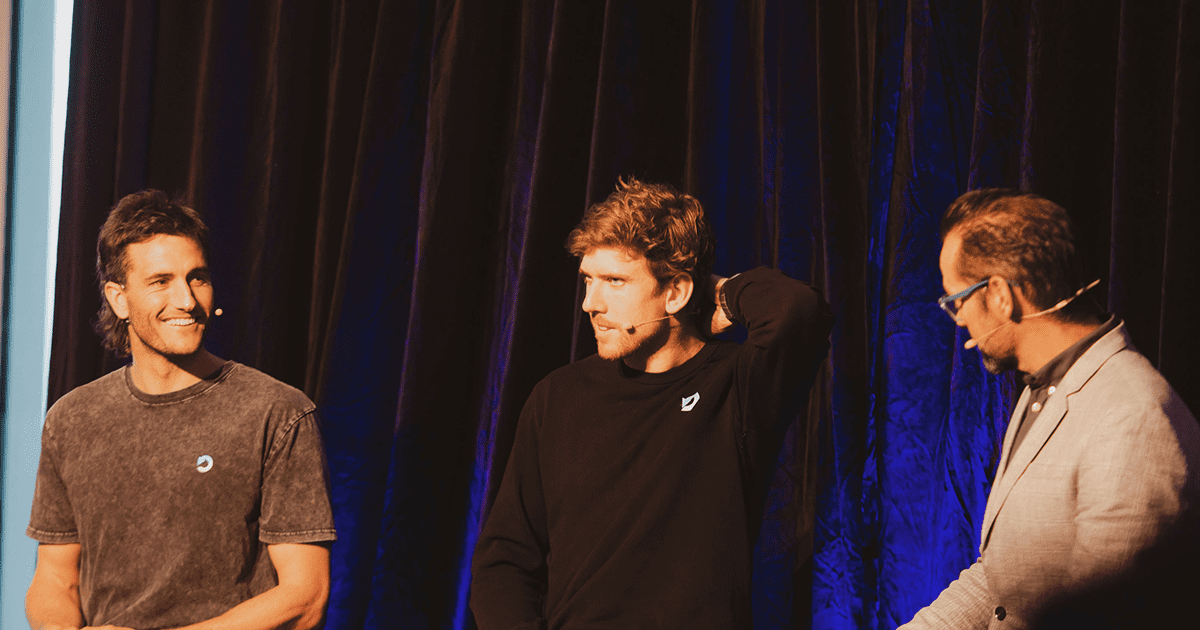

TMNZ is Now a Partner of Live Ocean

On Thursday, 15 October 2020 TMNZ announced a new partnership with Live Ocean. The announcement at Akarana Yacht Club, where TMNZ used to have their HQ and Live Ocean founders Blair Tuke and Peter Burling first sailed a 49er, aims to turn around some pretty worrying stats about the state of our ocean by accelerating positive ocean action in New Zealand. 94% of New Zealand’s area is ocean, and like business, ocean health is a cause that deserves and demands our leadership.

The story of giving for TMNZ and its founder isn’t new. After pitching the idea of tax pooling to various governments for almost 20 years, Ian and Wendy decided to ‘take the helm’ and mortgage their home to get the industry and TMNZ started in 2003. Since then they have continued to support people and causes that make a difference to the lives of others in NZ. Partnering with Live Ocean is one entry amongst a growing list where all profits are committed to charity each year.

Ian has always had an interest in sailing and saw first-hand the positive impact that Team New Zealand had in Valencia, San Francisco and Bermuda. He was impressed by Peter and Blair, who at the top of their sport, want to find time to make the world a better place. Partnering with them seemed almost fated.

When asked what the support of TMNZ means for Live Ocean, Peter said “So little of our Ocean is protected, 90% of our seabirds are at risk. This helps us fund projects that reverse these trends”.

As a foundation partner of Live Ocean, we see the potential to unlock capability and funding for ocean conservation in New Zealand. When our people are at work, they know they’re helping build a better New Zealand.

To learn more about Live Ocean and the work they are doing visit liveocean.com

TMNZ stepping up for Leukaemia & Blood Cancer New Zealand

TMNZ staff are raising money for Leukaemia & Blood Cancer New Zealand by racing up the tallest building in the Southern Hemisphere next month.

Grace Evetts, Mara Fisher, Neil Bhattacharya, Jatin Sharma and Lee Stace – collectively known as the ‘TMNZ Fast Five’ – are participating in this year’s Step Up Sky Tower Stair Challenge on 9 August.

They will join other teams from across New Zealand in racing up the 1103-step Auckland Sky Tower . The structure stands an impressive 328m and is 51 floors.

The money TMNZ raises will help Leukaemia & Blood Cancer New Zealand pay for patient support, research, information and advocacy.

About Leukaemia & Blood Cancer New Zealand

Leukaemia & Blood Cancer New Zealand is the national charity that supports patients and their families.

Blood cancers combined are the fifth most common form of cancer in New Zealand. An estimated 21,000 people live with blood cancer or a related condition.

In fact, six children and adults in New Zealand are diagnosed with a blood cancer like leukaemia, lymphoma and myeloma every day.

Despite doing such fantastic work, Leukaemia & Blood Cancer New Zealand receives no government funding.

The Step Up Sky Tower Stair Challenge is a key fundraiser for this organisation. That's why TMNZ staff are exercising their social responsibility by competing in this event.

How you can help

If you wish to sponsor one of the individual team members or donate directly to the team, you can do so here.

The TMNZ Fast Five are training hard to ensure they are fit and strong enough to tackle the Step Up Sky Tower Stair Challenge.

However, they cannot raise much-needed funds for Leukaemia & Blood Cancer New Zealand without the generosity of others.

They will appreciate any donations, so please give whatever you can.

And remember, anyone who makes a donation of $5 or more is eligible to receive a 33.33 percent tax credit or rebate from IRD.