Coffee with Ann from Q2 Accountants

Have you ever wanted to sit down with an accountant and discuss topics related to business and provisional tax in depth? We were given the opportunity to do just that with Ann Cooper Smith, the Founder & Chief Executive of Q2 Accountants.

If you don't know who Ann is, she is a chartered accountant with 30 years experience in the public sector. The combination of her personal experience and passion for seeing businesses thrive are what give her a personalised approach to the questions we asked. A handful of those questions are below:

- What are Q2 trying to achieve for its customers?

- What should a business look for in an accountant?

- How does tax pooling provide solutions for your clients?

You will hear how Ann has learned how to use tax pooling creatively for her clients so they can further invest in their businesses while paying their provisional tax.

Take some time today to watch this video as it will give you some framework on how success can be achieved through smart planning.

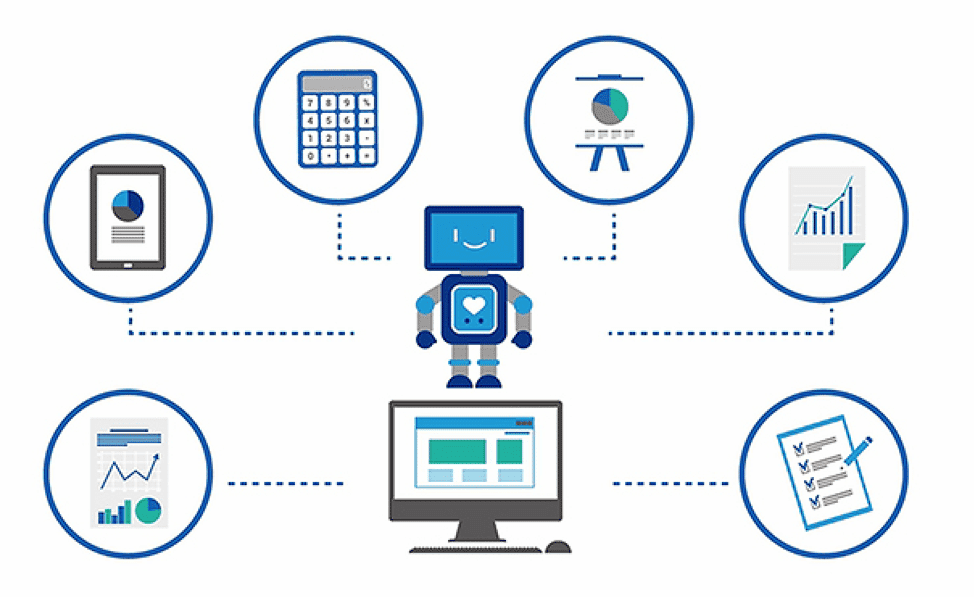

10 real world cases of robotic process automation (RPA) in accounting

The future of robotic process automation (RPA)

is looking brighter and brighter, as software robots become more and more

prevalent cross-industry. The Deloitte Global RPA Survey estimates not more

than 5 years before near-universal RPA adoption.

Accordingly, we’re taking a look today at the

effects and application areas of robotic process automation in accounting, as software

robots are expected by people from within to revolutionise the industry.

In fact, intelligent automation is the new

buzzword in accounting. And this is the case for very good reasons. Accounting

processes, such as order to cash, procure to pay, finance transformation, etc.,

require collection and analysis of large amounts of data, while also being rule

based and repetitive. Moreover, precisely due to features such as these, they

also trigger employees’ long faces and migraines. So robotic process automation

in accounting seems to be a match made in heaven.

A McKinsey report confirms, by estimating a

global automation potential of 43% for finance and accounting. Relatedly, UiPath specifies an automation rate of 80% for

common processes like accounts receivable or accounts payable.

Let’s take a closer look at some robotic

process automation real world use cases and learn some strategic steps towards leveraging

RPA in accounting.

Robotic process automation (RPA) use cases in accounting

The list of 10 concrete application areas of robotic process

automation in accounting is meant to assist you in conceiving a

‘roadmap’ of means towards your business objectives. The processes that we’re

going to discuss are meant to assist you in devising an efficient automation

journey.

1. Accounts payable (AP)

We were saying that such tasks seem to hold

the lead when it comes to leveraging RPA in accounting. Software robots can transfer inbound invoice information (like

invoice number, data received or dollar amount) from PDFs into SAP web

applications, and internal spreadsheets. Consequently, they can place a PDF

duplicate on an internal server. This is a very useful thing to do in order to

ensure regulatory compliance, and it can reduce up to 60% of vendor invoice

processing cycle times.

2. Accounts receivable (AR)

Bots can handle more easily (i.e., faster and

more accurately) the maintenance of customer master files and credit approvals.

The same goes for order, and AR cash receipts processing. As a nice final

touch, late notices can be sent by email more quickly, thereby minimising the

hassle that naturally comes with last-minute notifications.

3. Controller function

Bots can automatically reconcile the current

period invoice data feed against the last period, whenever the controller opens

the data file. This drastically reduces the processing time needed to compare

data across different periods.

Data that cannot be so easily handled, i.e.,

that trumps automatic reconciling, are the exceptions, and those are delivered

for processing to human accountants. The results are much faster, and the

employees can deal only with slightly more exciting data, or data ‘with a

twist’.

4. Cost allocation

Automation easily merges data from different

sources (like emails, Excel spreadsheets, Google documents, etc.) into a master

file, which can then be uploaded directly into an Enterprise Resource Planning

(ERP) and data management program. This can be done by software robots in no

time, i.e., less than one minute.

5. Financial close and reporting

This is an epitome of inter-departmental,

multisystem processing. We believe there is no exaggeration to say that posting

tax entry data from various business units is a monotonous, headache-provoking

task. Which is why it’s worth to have a software robot mitigate it. Moreover,

its error-proof potential also adds value to the process.

6. Accounting reconciliation

Accounting data calls for reconciliation of

subaccount balances taken from a variety of sources, such as Excel sheets, or

customer invoices. You can automate the process and download the data into

desired format. Data validation and exception search can then be performed much

faster. This is the case because balancing journal entries are created, and

judiciously used to handle invoice discrepancies.

7. Delivery reconciliation

Orders must be validated against shipments,

which requires that delivery notes be reconciled with purchase orders. We can

almost hear your inner dialogue: “Oh my, this is so much easier said than

done!”. Well, not necessarily, if you get assistance from a bot that’s able to

check and approve all “well-behaved” matching orders. It would only notify you

when encountering an exception, calling for your beautiful mind to decide what

is the best way to handle it.

8. Supplier pricing comparisons

Among quote to cash activities, accountants

must prepare customer quotes. To this end, they must carefully go through

potentially very large lists of suppliers’ prices and compare them. Bots can

significantly ease the burden on your shoulders, by providing accurate

comparisons in little time.

9. Operational finance and

accounting

Pricing reviews, as well as rebates

processing, can be automated based on reviewing customer contracts and

pre-approved price lists. Upon processing the detailed data of monthly sales,

commissions can be accurately calculated. Ultimately, the outcomes can be

gathered in files and emailed to required recipients in order to gain

approvals.

10. Regulatory reporting

Software robots are good candidates for

handling the burdensome task of collecting and cleansing the data, and then

automatically generate regulatory reports. Moreover, when it comes to complex

end-of-year reporting, RPA can streamline the process by means of

pre-populating spreadsheets.

Conclusion

The list above illustrates some of the

accounting processes which, if passed on to bots, can help businesses to

function more efficiently, while at the same time reducing operating costs. The

RPA use cases in accounting sketch an assistant profile that promises to lead

towards reaching your business targets.

However, we wish to pinpoint that assistance

and competitive advantage are the keywords here. The use of robotic process

automation illustrates a humanistic, person-centred approach to doing business,

where people really matter. The role of human employees remains vital in

accounting. With the help of software robots, they are freed to focus on

complex decision making, and person-to-person interactions with clients.