TMNZ: 100% invested in a better Aotearoa

We’re proud to invest 100% of our profits in Whakatupu Aotearoa Foundation to help the environment and community. We have a shared goal to help build a better Aotearoa and make a difference to our people and planet. Discover how working with TMNZ enables us to achieve our goals.

Nearly 20 years after we broke the mould as the world’s first tax pool, we’re reimagining what it means to be a purpose-driven business by investing our profits back into the people and environment of Aotearoa through the Foundation.

In 2003, TMNZ was born, from a desire to help improve the tax environment for New Zealanders. Our founder Ian Kuperus created the first ever tax pooling intermediary in April that year, becoming the first mover in an innovative, uncharted industry.

Our company has evolved significantly since then.

Now operating a pool of up to $10 billion, we have supported more than 100,000 taxpayers. Over the decades, we have helped countless businesses and sole traders better manage their Inland Revenue tax payments, making the provisional tax system easier for New Zealanders to navigate.

Aside from driving tax innovation, philanthropy has always been a significant part of our story. Here’s how it has informed our past, and how it will influence our future.

Our history of giving

In the early days of TMNZ, our founders Ian and Wendy Kuperus had a strong philanthropic vision; to support organisations reaching communities across Aotearoa, making a difference in the lives of New Zealanders. For many years they donated significantly through their private charitable foundation, sharing the stories of impact with people along their journey.

Ian and Wendy stepped back from the day-to-day running of our business in 2011, but over the past 11 years, their ambition to make Aotearoa a better place has strengthened. With the growing pressures on our environment and social challenges in our communities, their goal of making an impact has grown.

As more people and businesses join our tax pool each year and our business continues to grow, we have increased our efforts to ensure we make a difference with our profits and benefit New Zealanders for generations to come.

In 2020, Ian and Wendy decided they would commit the profit of the business to Whakatupu Aotearoa Foundation to support philanthropy and charitable initiatives. They wanted to enable TMNZ to help drive change in New Zealand and create something that would leave a lasting legacy, addressing some of the key issues facing our country.

How Whakatupu Aotearoa Foundation works

Whakatupu Aotearoa Foundation was established in 2020 to continue the great work of our founders. All of TMNZ’s profits are directed towards Whakatupu Aotearoa Foundation to support philanthropic and impactful initiatives, and our goals and objectives as a business and Foundation are more closely aligned than ever. Everything we do as a company is designed to give back to New Zealand.

The Foundation and TMNZ have a vision for a restored and thriving Aotearoa. Our business generates profits and resources that go towards these strategic philanthropic endeavors. Our people are all engaged in this purpose every day.

Everyone who works at TMNZ is connected to our purpose and the work of our Foundation. Our people know that alongside their day job of making tax more flexible for Kiwis, we have an underlying objective to make a difference to our nation’s future.

Climate change is a significant focus area for the Foundation. We are seeing rapid changes to our environment that pose a threat to our future, our people and our ecosystems. The Foundation also strives to help marginalised and disadvantaged communities, which are more significantly impacted by our nation’s challenges, including the threat of climate change.

Whakatupu Aotearoa Foundation invests in projects that are designed to create lasting impact for our environment and communities. The Foundation seeks to ignite ideas that may not otherwise have been realised and its support is both financial and strategic. People working for the Foundation offer guidance and connect projects to external skills through the Foundation and TMNZ’s broad network.

Whakatupu Aotearoa Foundation is inspired by the entrepreneurial spirit of TMNZ’s founders. As the first tax intermediary in the world, TMNZ took risks to get where it is today, going to places where none had gone before. The Foundation promises to do the same, and help to accelerate change as quickly as possible to tackle complex issues.

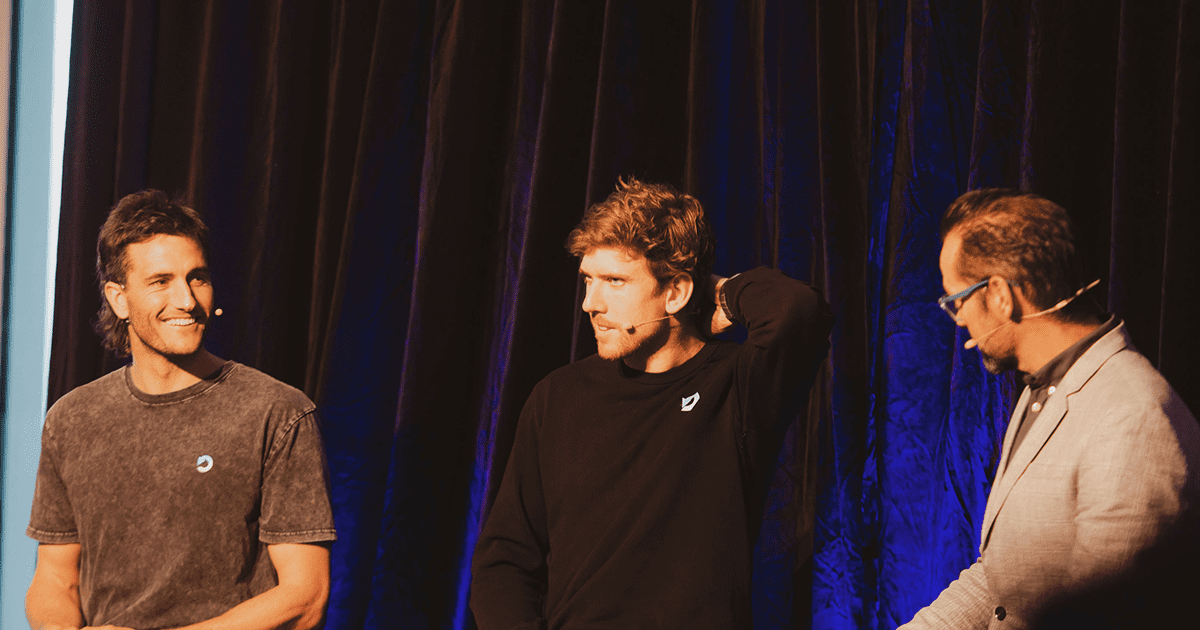

How does the Foundation do things differently? By making catalytic investments to help set up projects and platforms such as Live Ocean Foundation. Having seen first-hand through their sailing careers how interconnected the world is through the ocean, and realising the critical need to look after it, yachtsmen Peter Burling and Blair Tuke founded Live Ocean Foundation.

It partners with exceptional New Zealand scientists, innovators and communicators to scale up action for a healthy ocean. New Zealand has the world’s fourth largest ocean area, yet only 0.4% is protected. Oceans are one of our greatest allies in the fight against climate change and we must do more to look after them. Whakatupu Aotearoa Foundation has been supporting Live Ocean from its early days to achieve its goals.

Purpose for our people

We’re proud to be a purpose-led business, investing in our people, clients, communities, and the environment. Our purpose is underpinned by our core values; be socially conscious, be the change, collaborate and connect, and make it easy.

Increasingly, people are looking for purpose in their work, and we are proud to offer each of our employees the chance to donate $1,000 to a registered charity of their choice every year. It’s a small gesture that makes a big difference — our people can personally direct funding to a charity that has affected their lives, or the lives of loved ones.

We give autonomy to our people, enabling them to engage in philanthropy from a personal level and contribute to causes that are meaningful to them, as well as supporting Whakatupu Aotearoa Foundation through their everyday work at TMNZ. The initiative has helped us to learn more about our people and what is important to them as we continue to embed philanthropy into our company.

Becoming more sustainable

In line with our goal to build a restored and thriving Aotearoa New Zealand, at TMNZ and Whakatupu Aotearoa Foundation we have turned the spotlight on ourselves over the past year to deliver a holistic approach to sustainability.

Earlier this year, we moved our headquarters in Auckland to a state-of-the-art sustainable office on 23 Customs Street, putting the environment and our people at the heart of the design.

During the year leading up to the move, we developed our sustainable new headquarters with consideration for climate change, environmental impact and waste mitigation, as well as providing a welcoming space for our people, and clients, and partners of TMNZ and the Foundation.

Engagement sessions with our employees ensured that everyone was involved in the moving process. Every aspect of the design, from flooring to furniture, was chosen with sustainability in mind, with recycled and reused materials incorporated throughout,

The vision was made a reality on moving day in March as we moved into our new home. TMNZ and Whakatupu Aotearoa Foundation have a continued commitment to reducing our environmental footprint, cutting down on waste, and finding new ways to improve on sustainability.

Relentless innovation

True to our values back in 2003, TMNZ remains relentlessly focused on tax innovation and making life easier for our clients. Technology will continue to drive innovation and enhance our services in the years to come.

Our business is in transformation mode, and we will continue to explore new ways to meet our clients’ growing demands.

Already this year, we have introduced Inland Revenue integration for our clients, with the help of Reckon/APS, and sustainable e-signature provider Good Sign. Further innovation is on the way.

We have been selected by Ministry of Business, Innovation and Employment as delivery partner, for the R&D Tax Incentive In-Year Payments Scheme. New Zealand businesses performing eligible R&D will soon be able to access R&D Tax Incentive credits much earlier, with the introduction of in-year payments in 2023. We are excited to be part of a solution that will help R&D companies doing great work to grow our economy.

100% invested in a better Aotearoa

By delivering a great service to our clients, making a profit, and donating to Whakatupu Aotearoa Foundation, we can help to tackle environmental and social challenges, putting our country in a stronger position to face the future with confidence.

Our goal to deliver the best tax solutions for Kiwis won’t change. But the impact we can make will. Whether it’s delivering flexible tax services to our clients, or working with charitable partners to drive change across Aotearoa, both TMNZ and the Foundation are committed to making a positive impact.

By investing our profit back into the Foundation to support its initiatives for the environment and community, our clients, our business, and our Foundation are all in it together.

Carl Vink, Chief Executive of Whakatupu Aotearoa Foundation, says: “It is an exciting journey, that we all are on across TMNZ, the Foundation and our project partners. We are united by taking on the biggest challenges facing our nation. There is no better motivation."

“This is such a unique opportunity to make a difference and infuse the goals of the Foundation into TMNZ,” adds Chris Cunniffe, Chief Executive of TMNZ. “Our business is fully invested in our country.”

Live Ocean - Impact Story

The ocean is a life support system for our planet – it provides 50% of our oxygen, has absorbed 90% of the extra heat we have produced, and can host thriving ecosystems of marine life. But climate change is affecting what’s above and below the waterline. Our oceans are changing, they’re heating up, becoming more acidic, and are at a tipping point.

Aotearoa is an ocean giant. We have the fourth largest ocean space in the world, but we only protect 0.4% of it. As guardians, it’s our role to look after, protect and restore it so that life can flourish.

Having seen first-hand through their sailing careers the interconnectedness of the world through the ocean, and realising the critical need to look after it, in 2019 sporting legends Peter Burling and Blair Tuke founded Live Ocean Foundation. It partners with exceptional New Zealand scientists, innovators and communicators to scale up action for a healthy ocean.

An example of research taking place is the documenting of kelp forest loss in Tīkapa Moana, the beautiful Hauraki Gulf. Beneath the surface the ecosystem is in crisis. A key tohu or indicator is the kina barrens that have become prevalent where kelp used to thrive. Live Ocean Foundation is supporting research into the significance of kelp forests and their regeneration. This research is led by Dr Nick Shears and Dr Caitlin Blain from the University of Auckland. The research is looking at how we can protect and restore coastal areas to encourage kelp forests to bloom and those ecosystems to recover. It’s also investigating how kelp forests contribute to carbon cycles, providing an exciting potential opportunity to quantify blue carbon.

“There is no option other than to act, together and with urgency to secure the ongoing health and productivity of the ocean.” – Sally Paterson, Chief Executive, Live Ocean Foundation (Speaking at the United Nations Ocean Conference, Lisbon 2022)

In 2022, Peter Burling and Blair Tuke presented a commitment of over 120 leading sportspeople and ocean communities to the UN Secretary General’s Special Envoy for the Ocean, Ambassador Thomson, at the UN Ocean Conference in Lisbon. This is part of Live Ocean’s work to create a platform that amplifies the voices of sportspeople – calling for better global marine protection on the world’s stage. Here, Chief Executive Sally Paterson spoke to the conference on behalf of Live Ocean Foundation, presenting its work.

Whakatupu Aotearoa Foundation’s journey with Live Ocean Foundation started two years ahead of Lisbon. With the combined talents of Peter Burling, Blair Tuke and Sally Paterson on board it was clear that their strong leadership, diverse connections, experience and a shared global vision for the ocean could create much-needed kinetic action. Action that is required across government, business and communities. As an initial partner, Whakatupu Aotearoa Foundation was able to provide catalytic funding to help establish Live Ocean and provide core infrastructure to set up and run the organisation.

As Founder of Whakatupu Aotearoa Foundation and a keen recreational sailor, Ian Kuperus relates to Live Ocean’s mission. “The sea connects us all, we rely heavily on its prosperity and we are bound together to protect it. As a nation of voyagers and travellers who have made our home on a group of islands way out in the Pacific, our identity extends to the water as much as the land. We are all invested in its restoration, and I am inspired by the team’s urgent and considered progress at Live Ocean.”

By the numbers

As at October 2022

11

projects

2.4m

people reached

$850k

our investment

All Heart NZ - Impact Story

An extraordinary amount of corporate and construction, or demolition, material ends up in landfill when owners consider it to have reached the end of its useful life. It is these materials that make up the large majority of what goes into landfill, currently about 83%, but what else can we do with it?

Joe Youssef placed himself at the heart of this question and rose to the enormous challenge of repurposing and redistributing perceived ‘waste’ to those who look at it as an exceptional, life-changing resource. He founded All Heart NZ in 2016 and communities around Aotearoa began receiving office chairs and tables, storage furniture, stationary, de-branded clothing, technology, hotel linen and repurposed retirement-home furnishings. Everything, including the kitchen sink!

All Heart NZ employees come from all walks of life and Joe seeks to bring on staff who are looking for a chance, helping them to return to the workforce, for whatever reason, and gain meaningful employment. Roles are varied and have recently extended towards upcycling materials that need work before they can be redistributed, and breaking down materials into their separate recyclable parts, diverting them from landfill and extending their use.

“We have a tendency to think and act in a linear way. We extract resources to create a thing that is then sold, consumed, and ultimately thrown away. That has to stop. At All Heart NZ we don’t talk about waste, we talk about resource.” – Joe Youssef, Founder and Chief Encourager, All Heart NZ

“Businesses aren’t buildings, they are people,” Joe reminds us. As soon as a better way becomes available, people are drawn to it. Since All Heart NZ started six years ago, the All Heart NZ network of providers and recipients has grown to a level that requires minimal storage. An All Heart NZ driver will pick up and drop off all items on the same day as matches are made in advance. There is also a social enterprise stream at All Heart NZ. Items that can be repurposed or sold are taken through the retail network, All Heart Store, providing a circular solution for the resource, creating further employment, volunteerism, and training opportunities.

With All Heart NZ looking to grow further outside of Auckland, establishing its regional All Heart Store network was key. However, funding was a significant constraint. Through the partnership with the Whakatupu Aotearoa Foundation, Joe has been able to explore new initiatives and grow the store network, including adding additional services to the business model, enabling corporates to strategically rethink and redesign waste out.

Having seed funders that can appreciate the vision and get behind it is absolutely critical. Joe worked closely with Carl Vink, Chief Executive of Whakatupu Aotearoa Foundation, on realising the vision. “Joe is one of the leading lights in trying to change the mindset of our businesses and communities, while also providing the critical infrastructure to help organisations do better with the material they no longer need,” says Carl.

By the numbers

As at October 2022

4.4m kgs

resources recovered

355

community recipients reached

1,770

corporate providers reached

$340k

our investment

Tax Policy Scholarship showcases the next generation of talent

Four bright young industry minds have emerged as finalists in this year’s Tax Policy Scholarship Competition, an annual prize hosted by the Tax Policy Charitable Trust.

The biannual competition, which supports the continuation of leading tax policy research and thinking in New Zealand, enters its fourth round in 2022. The first competition was run in 2015.

The scholarship is designed to inspire the next generation of tax industry leaders. This year, entrants under the age of 35 were invited to propose significant reforms to our current tax system or analyse potential weaknesses and unintended consequences from existing laws, and propose changes to address them.

Entrants were asked to tackle one of three topics: environmental taxation, tax administration, or the powers granted to the Commissioner of Inland Revenue to collect information for tax policy purposes. Participants were invited to address the topics with creative ideas backed up by reasoned research and analysis.

We are delighted to announce the four finalists for this year’s competition, selected by our panel of leading tax industry professionals.

Daniel Doughty

Daniel is a Senior Consultant with EY in Wellington. He has proposed the introduction of a small business consolidated reporting regime to simplify tax reporting for small companies.

The regime would consolidate pre-existing tax obligations into a single report to be filed every second month. Inland Revenue would send an automated income summary out at the end of the year, similar to those currently prepared for individuals.

Mitchell Fraser

Mitchell is a Tax Solicitor with Mayne Wetherell in Auckland. Mitchell is concerned that the recently-expanded powers granted to Inland Revenue to collect information for tax policy purposes could create unintended consequences.

He believes the new powers risk political interference, conflicting with the IR’s need to be politically neutral. Mitchell proposes identifying alternative means to collect this information, including through Statistics New Zealand.

Vivien Lei

Vivien is Group Tax Advisor with Fisher & Paykel Healthcare, and finance lead with the Fisher & Paykel Healthcare Foundation.

Vivien proposes to change New Zealand’s environmental practices through the introduction of an impact-weighted tax regime. Under this model, organisations would be taxed on their net positive or negative impact on the environment.

Jordan Yates

Jordan is a Senior Tax Consultant with ASB in Auckland.

Jordan believes the tax policy landscape is fractured, and suffocated by political roadblocks. His proposal is to establish an independent statutory authority that would be responsible for the independent management of fiscal policy, as it relates to the tax base.

Selecting a winner

The finalists were announced on 2 June, and each will go on to develop a 4,000-word submission on their proposal.

The four will be invited to present their final proposals and answer questions at a function in October 2022. The winner will be announced that evening.

Our Tax Policy Scholarship Competition celebrates creative thinking from young professionals and also provides a springboard for the brightest industry minds to develop their careers.

Nigel Jemson, the winner of the 2019 competition, says: “Entering the competition was a terrific opportunity for me to grow and develop my tax policy thinking and connect with leading minds in the tax community. Winning the competition has given my career a boost and since, I have enjoyed a range of great roles in tax for leading businesses, Spark and PwC, and continued my involvement in and passion for New Zealand tax policy.”

Chris Cunniffe, Tax Policy Charitable Trust Committee Member and TMNZ Chief Executive, says this year’s entries underline the strength of the next generation.

“We’re consistently delighted with the breadth and the freshness of thinking young people bring to this competition. The competition provides a forum to share ideas, and secondly, ensures that creative tax policy is not the sole domain of people who have worked in the industry for a long time. As an industry, we are open to fresh thinking and new ideas.”

Tax Policy Charitable Trust Chair John Shewan says the entries prove the industry’s future is in good hands.

“New Zealand has been very fortunate to have so many competent tax leaders involved in developing policy for the betterment of our country. It’s very exciting to be around the next generation of future tax policy influencers, who are already, at a young age, focused on innovative opportunities to enhance the tax landscape.”

Michelle Redington, Chief Tax Counsel at Inland Revenue, who was the guest speaker at the event where the four finalists were announced, says it is fantastic to see the Tax Policy Charitable Trust create opportunities for the next wave of tax policy thinkers.

“Throughout my career, I have been very lucky to be supported by some of New Zealand’s preeminent tax leaders, who have been fantastic teachers and mentors,” she says. “I’ve enjoyed a diverse career in tax, spurred on by a need to solve complex problems, and I’m proud to be able to give back to the next generation of talented tax enthusiasts.”

Find out more about the Tax Policy Scholarship Competition, here.

Using the Due Date on myIR statements may needlessly expose you to UOMI

Let's talk about how TMNZ can help you to avoid interest charges with payments at P3.

Unfortunately we're seeing many clients buying tax at the wrong dates. We believe this is caused by the confusing way Inland Revenue displays the Residual Income Tax liability on the myIR statements. If a taxpayer doesn’t meet the safe harbour threshold of less than $60,000 RIT for the relevant tax year, paying tax at terminal tax date will cost you Inland Revenue Use of Money Interest (UOMI).

Why is this?

- Inland Revenue myIR transaction detail statements show the tax due split on what amounts are liable for late payment penalties and what amounts are not.

- As late payment penalties are charged on the lesser of the standard uplift amounts and RIT/3 for all provisional tax dates, they will usually show two amounts for the P3 date. The standard uplift amount will be shown as due at P3, and the balance of current year RIT will be shown as due at the Terminal Tax date.

- However, what is not clear on myIR is that use of money interest will be charged on the combined P3 total, from P3 to the date the tax is paid.

- So those that are not transferring the combined total at P3 but transferring the amount at the terminal tax date, will incur interest from the P3 date.

How can I stop this?

When transferring or purchasing tax from the TMNZ tax pool, you should be doing this for the combined P3 amount at the P3 date. This will mean you avoid interest charges.

To find out more, get in touch.

Disclaimer: This article is correct as at 19 April 2022. It is subject to change.

TMNZ’s sustainable office: how we moved and improved our environmental footprint

Our new Auckland office aligns with our ambition to build a more sustainable future for Aotearoa. Here’s why we made the move.

When we kick-started the process of finding a new Auckland home last July, we were eager to do things differently and place a strong emphasis on sustainability. At TMNZ, we’ve always been conscious of the environment, but we wanted to go a step further as we developed our new corporate headquarters.

We wanted to ensure people and the environment were at the heart of our new workspace design. We needed to find the right setting for our Auckland employees and develop an office that would help us become more sustainable. Moving required a holistic approach, incorporating climate change, environmental degradation, and waste mitigation.

“We wanted to create a great workplace for our people to enjoy. They were involved throughout the project,” says Amanda Thorpe, TMNZ’s Head of People and Culture. “Our people helped us select the office space and we ran engagement sessions with employees to discuss aspects of the design. We worked together to make our vision a reality for both TMNZ and the Whakatupu Aotearoa Foundation, as we continue to support the trust’s philanthropic efforts.”

The environment is a big focus for TMNZ and the Whakatupu Aotearoa Foundation. Through the Foundation we look to invest in initiatives that tackle climate change, environmental degradation, declining biodiversity, and waste. It was very important to us to give the same environmental focus and attention to the design of our new workplace.

Building a sustainable home

We selected an office at 23 Customs Street in Auckland and enlisted Peter Doyle, from NOWW Advisory and Wingate Architects, to help us build an eco-friendly workspace. Together we explored how we could reduce our environmental footprint with each decision.

”Materials used in the new space have been chosen with sustainability in mind,” says Sarah Bryant, Associate Senior Interior Designer at Wingate Architects. “TMNZ’s new home features Jacobsen’s carpets made from recycled drinking bottles, Tarkett hard floors manufactured from recycled PVC, and Green Tag Certified Autex Cube ceiling tiles, made with at least 40 percent recycled materials.”

We selected sustainably-sourced mataī joinery and panels, and recycled rimu tables. We also chose sustainable furniture fabrics for every chair and stool.

No detail was too small; desktop surfaces at TMNZ are now made of all-natural linoleum, produced from pure oxidised vegetable linseed oil and natural pine rosin. We also made use of recycled products, including a reused office pod that hosts our breakout meetings.

Making an impact, without waste

While we took a careful approach, moving from one place to another inevitably produces waste. In our case, much of our old furniture was no longer suitable for the new office. Our people worked to find a solution and struck upon an idea to recycle and make a social impact at the same time.

To ensure nothing went to landfill, we teamed up with All Heart NZ, a charitable organisation that works with corporates to redirect and repurpose unwanted corporate and construction items. The organisation offers ‘Reduce partnerships’, which help to further develop the sustainable, ethical, and social aspects of procurement and supply chain management. All Heart NZ has established a national circular solution for redundant corporate items, which creates employment, volunteerism, and training opportunities while supporting local community need.

All Heart NZ helped us to achieve a positive social and environmental outcome by redirecting 216 items weighing more than 6,500kgs. With items reused, repurposed, and resold, 100 percent of the benefit went to New Zealand communities in need.

Joe Youssef, All Heart NZ’s Founder and Chief Encourager says: “We know that improving the ways we source and dispose of corporate goods can positively impact our planet and people. We partnered with TMNZ to redirect all redundant materials in preparation for their office move. Together we created a sustainable solution and community impact to be proud of.”

Through our partnership, we added $16,700 in community impact value and avoided 7.6 tonnes of carbon emissions. All Heart NZ’s partnerships have supported 439 different communities throughout Aotearoa and the Pacific, helping them save or raise more than $9.1 million, while at the same time assisting corporate partners to divert more than 3.7-million kilograms from landfill.

A welcoming space for our people

Our office was designed for our people. Collaborative spaces and new technology will enable us to work together and with our customers and partners regardless of where they are in New Zealand. Technology including whiteboard cameras, immersive collaboration spaces and fully cable-free working will make us more connected than ever and reduce the need for unnecessary travel. What’s more, we have chosen technology suppliers that lead in terms of their sustainability commitments while at the same time provide a seamless employee experience.

We moved into our new workspace in March, and our environmental sustainability efforts continue. We have made an ongoing commitment to reduce waste sent to landfill and we’re constantly exploring new ways to improve.

TMNZ and the Whakatupu Aotearoa Foundation have a shared vision of a “restored and thriving Aotearoa”. Our new workspace will allow both organisations to come together with clients and charity partners in an open, inviting environment — one that has been designed to limit the impact on future generations.

While COVID-19 restrictions have prevented us from welcoming visitors into our new home so far, we look forward to showing customers and charity partners our new surroundings in the months to come as we mark new chapters at TMNZ and the Whakatupu Aotearoa Foundation.

Survey indicates property market cooling due to confusion

News release: Chartered Accountants Australia and New Zealand and Tax Management New Zealand

26 November 2021

A survey of chartered accountants and tax agents has revealed that incoming legislation intended to help cool New Zealand’s over-heated housing market is already having a major effect on investors – but largely because of confusion and lack of detail rather than clear policy.

The annual survey, jointly run by Chartered Accountants Australia and New Zealand (CA ANZ) and TMNZ, sought the views of 361 accountants in public practice, on recent tax policy developments.

Among the findings, the survey revealed that 70% of respondents have already seen clients change or voice their intention to change their residential property investment behaviours due to ongoing changes to the extended bright-line test, and proposed changes to deny interest deductions.

CA ANZ NZ Tax Leader John Cuthbertson said that further results from the survey show to key factors in play; the complexity of the proposed rules, and uncertainty as the details could change before the legislation is enacted in March 2022, despite the bright-line and denial of interest deductions coming into play from earlier this year.

“The survey suggests that the housing market has been given a policy placebo, in the form of legislation that is influencing behaviour before it is fully developed and enacted.”

“Residential property purchasers and investors typically react to the specific detail of legislation. However, in this case the market appears to be reacting to the complexity of the proposed legislations carveouts and inconsistencies, and the fact that it won’t know exactly what is in place until March 2022, despite it being backdated to capture activity in 2021.”

“To be fair, the Government’s aim was to cool down the overheated housing market, which is causing a range of economic and social issues, but we’re not sure this is the best way to do it.”

The survey shows that over 21 per cent of the respondents, or 1 in 5, feel ‘not at all confident’ about advising clients on the proposed new build interest limitation rules, and over 65 per cent of participants felt the phase out and denial of interest deductions would be somewhat or extremely difficult to comply with.

Similarly, almost 50% of respondents said they were either somewhat confident, or not at all confident on advising on the new build bright-line test.

“Because this policy hasn’t been developed in line with the generic tax policy process (GTPP), there’s a much higher chance of unintended consequences and collateral damage. The survey shows a considerable lack of confidence in how the legislation will work, and that will likely result in non-compliance and issues around who is captured and who isn’t.”

“It’s important to note that the level of complexity encountered will depend on the number of properties owned, banking arrangements in place and the mix of interest limitation rules and concessions in play,” added Mr Cuthbertson.

TMNZ Chief Executive Chris Cunniffe said the survey provides a good indication of how the proposed rules would be rolled out.

“In their current complex form, there’s likely to be a lot of variability in compliance with these laws. Especially as not everyone has a tax agent or accountant helping them.”

“While the extension of the bright line test to 10 years might land well for most mum and dad property owners, the denial of interest deductions and how that relates to new builds is likely to be misunderstood.”

“There’s opportunity for Government to provide greater clarity on the law changes and simplify certain aspects to help owners and accountants alike.”

New Survey Shows Inland Revenue Helpful, But Hindered

Press Release: Chartered Accountants Australia and New Zealand and Tax Management New Zealand

24 November 2021

Helpful, but hindered is the overarching finding in a new survey digging into public practice accountants’ experiences with Inland Revenue (IR).

Conducted by Chartered Accountants Australia and New Zealand and TMNZ, the survey of 361 members in public practice asked a range of questions about the timeliness of IR’s service, the quality of interaction, and the business support on offer.

“Over 80 per cent of those surveyed rated their agent account manager interactions positively over the last 12 months, which Inland Revenue should be pleased with,” said CA ANZ NZ Tax Leader John Cuthbertson.

“The flipside is that it is taking much longer for Inland Revenue to resolve queries. The number of public practitioners who say it’s taking more than 6 days to resolve their queries has risen from 5 per cent of respondents, to 47 per cent.”

Despite this, accountants and tax agents are positive about not only their interactions with account managers, but also the support measures that Inland Revenue has administered.

“Accountants and agents across New Zealand are telling us that the tax support provided by Inland Revenue has been as effective this year, as it was last year,” said Tax Management New Zealand Chief Executive, Chris Cunniffe.

“It’s been another turbulent year for businesses, and the tax relief and support measures have made a positive difference. It’s just that our survey shows it can take a while to get through to Inland Revenue, and to have queries resolved and assistance locked in.”

The appreciation of Inland Revenue’s support was illustrated by 85 per cent of participants reporting that they had clients who utilised the remission of interest and penalties for late payment of provisional tax due to COVID.

Additionally, over 71 per cent of participants have found it easy or not difficult, to enter into or assist clients with an instalment arrangement in the past 12 months. This covers all types of tax, including GST, PAYE and FBT, not just provisional tax.

The increased level of scrutiny and information required to access COVID support was also felt by survey respondents.

“Approximately half the survey respondents said that accessing COVID support was harder than in 2020. That’s not surprising, given the public’s desire for more scrutiny about who received support, and the declarations becoming more stringent during this year’s lockdowns,” concluded Mr Cuthbertson.

Partnership with ATAINZ

March 29, 2021 — TMNZ today announces a partnership with The Accountants and Tax Agents Institute of New Zealand (ATAINZ). The partnership will advance TMNZ's ambition to accelerate the adoption of tax pooling solutions amongst taxpayers who would benefit from genuine provisional tax flexibility. In addition, TMNZ is announcing plans to commence offers and opportunities via the ATAINZ membership.

ATAINZ members will be able to look forward to the collaboration between TMNZ and ATAINZ. Starting from Q2 2021, ATAINZ members will have available tax pooling training, collateral options, and an ATAINZ point of contact at TMNZ.

Richard Abel, Chairperson of ATAINZ said: “Having been a user and supporter of tax pooling through TMNZ for a number of years, we’re excited to formalise an agreement with TMNZ for all our members. Signing the partnership with TMNZ affirms our commitment to being recognised as the voice of small-medium businesses (SME) in New Zealand. Tax pooling presents a cashflow solution that more should be aware of.”

Neil Bhattacharya, Head of Client Services at TMNZ said: “ATAINZ is a progressive organisation that is growing quickly and TMNZ is looking forward to partnering with them for the next 3 years and beyond. We feel strongly that tax pooling is a key cashflow tool for SMEs and a perfect match for ATAINZ clients looking for cashflow options.”

About ATAINZ

The Accountants and Tax Agents Institute of New Zealand (ATAINZ) exists to promote the welfare and professional development of its members and to represent members' interests in New Zealand. It is unique in the New Zealand tax and accounting market because of its grassroots contact with members.

TMNZ is Now a Partner of Live Ocean

On Thursday, 15 October 2020 TMNZ announced a new partnership with Live Ocean. The announcement at Akarana Yacht Club, where TMNZ used to have their HQ and Live Ocean founders Blair Tuke and Peter Burling first sailed a 49er, aims to turn around some pretty worrying stats about the state of our ocean by accelerating positive ocean action in New Zealand. 94% of New Zealand’s area is ocean, and like business, ocean health is a cause that deserves and demands our leadership.

The story of giving for TMNZ and its founder isn’t new. After pitching the idea of tax pooling to various governments for almost 20 years, Ian and Wendy decided to ‘take the helm’ and mortgage their home to get the industry and TMNZ started in 2003. Since then they have continued to support people and causes that make a difference to the lives of others in NZ. Partnering with Live Ocean is one entry amongst a growing list where all profits are committed to charity each year.

Ian has always had an interest in sailing and saw first-hand the positive impact that Team New Zealand had in Valencia, San Francisco and Bermuda. He was impressed by Peter and Blair, who at the top of their sport, want to find time to make the world a better place. Partnering with them seemed almost fated.

When asked what the support of TMNZ means for Live Ocean, Peter said “So little of our Ocean is protected, 90% of our seabirds are at risk. This helps us fund projects that reverse these trends”.

As a foundation partner of Live Ocean, we see the potential to unlock capability and funding for ocean conservation in New Zealand. When our people are at work, they know they’re helping build a better New Zealand.

To learn more about Live Ocean and the work they are doing visit liveocean.com